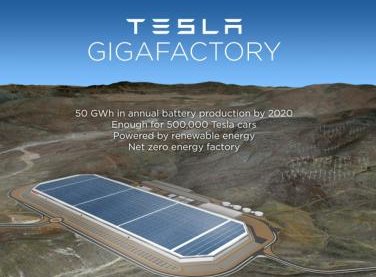

Working out production bottleneck for Model 3: Tesla’s battery partner said that production problems are being worked out at the Gigafactory in Nevada, which will get the Tesla Model 3 up to  speed in the near future. Panasonic CEO Kazuhiro Tsuga said yesterday that delays to the automation of the battery pack production line meant some of it had to be completed manually. It will soon be automated, meaning the number of vehicles to be produced will rise sharply, he said. Tsugu declined to comment on how his company sees the production schedule will be carried out compared to the original projection. Automotive demand from Tesla and other auto industry customers helped the Japanese electronics company’s operating profit rise 6% during the July-September period. Panasonic supplies battery cells for Gigafactory production of Tesla’s battery packs. Earlier this month, Tesla had said that manufacturing bottlenecks had caused the slowdown for the Model 3 – down to 260 produced versus the original goal of 1,500 during the past quarter.

speed in the near future. Panasonic CEO Kazuhiro Tsuga said yesterday that delays to the automation of the battery pack production line meant some of it had to be completed manually. It will soon be automated, meaning the number of vehicles to be produced will rise sharply, he said. Tsugu declined to comment on how his company sees the production schedule will be carried out compared to the original projection. Automotive demand from Tesla and other auto industry customers helped the Japanese electronics company’s operating profit rise 6% during the July-September period. Panasonic supplies battery cells for Gigafactory production of Tesla’s battery packs. Earlier this month, Tesla had said that manufacturing bottlenecks had caused the slowdown for the Model 3 – down to 260 produced versus the original goal of 1,500 during the past quarter.

Mazda will offer rotary engine plug-in hybrid: Mazda will be bringing out a plug-in hybrid powered by battery and a rotary engine in 2019. During the Tokyo Motor Show, the company confirmed that it will be launching an all-electric and extended range electric vehicle that year. Australian online publication Motoring reported that Mazda will be announcing a series of plug-in hybrids based on existing models around 2020. After that, then a battery electric vehicle will come out. It will be co-developed with Toyota and Denso in 2021 as part of its recently launched EV joint venture.

Plug-in sales doing well in Europe: September was the second best month ever for plug-in electrified vehicle sales in Europe. At about 33,700 all-electric and plug-in hybrid vehicles sold, growth  was up 32% year-over-year by the end of September. December 2015 had been its top selling month, with just over 33,800 units sold. Sales are expected to be strong in the fourth quarter, with historic data showing sales always improving over the last three months of the year in the region. Plug-in vehicles increased to 2.2% of overall new vehicle sales in Europe during September. Tesla saw its best month ever in Europe with the Model S coming in at #1 with an estimated 2,527 units sold. The next four on the list for top five selling PEVs in Europe during September were the Renault Zoe at 2,306 units sold, the Tesla Model X at 2,137, the Mitsubishi Outlander PHEV at 2,080, and the Volkswagen e-Golf at 2,041 units sold.

was up 32% year-over-year by the end of September. December 2015 had been its top selling month, with just over 33,800 units sold. Sales are expected to be strong in the fourth quarter, with historic data showing sales always improving over the last three months of the year in the region. Plug-in vehicles increased to 2.2% of overall new vehicle sales in Europe during September. Tesla saw its best month ever in Europe with the Model S coming in at #1 with an estimated 2,527 units sold. The next four on the list for top five selling PEVs in Europe during September were the Renault Zoe at 2,306 units sold, the Tesla Model X at 2,137, the Mitsubishi Outlander PHEV at 2,080, and the Volkswagen e-Golf at 2,041 units sold.

chargers in operation; 2,183 of them are fast chargers, including Tesla’s Superchargers. Available charging stations are in place at retail stores, shopping malls, movie theaters, and restaurants; and more are showing up at workplace parking lots and city government sites such as libraries. Recent first-time EV buyers are finding what EV owners have experienced in recent years. They charge their EVs at home overnight, and top off for shorter periods while at home our out running errands. Most of the U.S. charging infrastructure is located on the coasts, and fast charging stations differ based on the electric car being driven. EVgo is one of the infrastructure suppliers working at bringing more fast chargers to public charging sites. Most of them have 50-to-60 kW charging capacity for now, and up to 150 kW; with testing being done on chargers that can go up to 350 kW. That ultra-fast charger will be able to give long-range EV about 250 miles of range in about 15 minutes of charging. Most of the changes currently being made at charging stations come from upgrades at these stations, but moving up to high-capacity fast chargers will take more space, construction, and investments in the future. “For the new stations that we’re designing where possible, we’re reserving the power capacity required to serve those higher levels and laying out the stations so that all it will take is a booster in the back of the stations so that you can get up to the higher level,” said Terry O’Day, vice president of product strategy and market development at EVgo.

chargers in operation; 2,183 of them are fast chargers, including Tesla’s Superchargers. Available charging stations are in place at retail stores, shopping malls, movie theaters, and restaurants; and more are showing up at workplace parking lots and city government sites such as libraries. Recent first-time EV buyers are finding what EV owners have experienced in recent years. They charge their EVs at home overnight, and top off for shorter periods while at home our out running errands. Most of the U.S. charging infrastructure is located on the coasts, and fast charging stations differ based on the electric car being driven. EVgo is one of the infrastructure suppliers working at bringing more fast chargers to public charging sites. Most of them have 50-to-60 kW charging capacity for now, and up to 150 kW; with testing being done on chargers that can go up to 350 kW. That ultra-fast charger will be able to give long-range EV about 250 miles of range in about 15 minutes of charging. Most of the changes currently being made at charging stations come from upgrades at these stations, but moving up to high-capacity fast chargers will take more space, construction, and investments in the future. “For the new stations that we’re designing where possible, we’re reserving the power capacity required to serve those higher levels and laying out the stations so that all it will take is a booster in the back of the stations so that you can get up to the higher level,” said Terry O’Day, vice president of product strategy and market development at EVgo. the lead. The race covered 3,022 kilometers (1,880-mile) race from Darwin to Adelaide. Stella was able to gain double the efficiency points of the second-place team. The solar-powered electric car uses a unique Solar Navigator platform from Ericsson’s Connected Urban Transport. Stella was started and created years ago by Solar Team Eindhoven from the Eindhoven (Netherlands) University of Technology, and has been widely recognized and is gaining support. In 2015, Stella won the TechCrunch award for biggest technology achievements during the 8th annual “Crunchies Awards” against an impressive list of contenders.

the lead. The race covered 3,022 kilometers (1,880-mile) race from Darwin to Adelaide. Stella was able to gain double the efficiency points of the second-place team. The solar-powered electric car uses a unique Solar Navigator platform from Ericsson’s Connected Urban Transport. Stella was started and created years ago by Solar Team Eindhoven from the Eindhoven (Netherlands) University of Technology, and has been widely recognized and is gaining support. In 2015, Stella won the TechCrunch award for biggest technology achievements during the 8th annual “Crunchies Awards” against an impressive list of contenders. manufactured this year to about 500,000 next year – mostly through the Model 3 –

manufactured this year to about 500,000 next year – mostly through the Model 3 –  electric buses, but also for moving goods. Andy Swanton, vice president of truck sales at BYD,

electric buses, but also for moving goods. Andy Swanton, vice president of truck sales at BYD,  administration’s federal fuel economy and emissions standards. U.S. Sen. Sheldon Whitehouse (D-R.I.) was scheduled to participate in a conference call Wednesday with executives from Sierra Club, Environment America, Public Citizen, Greenpeace, and Safe Climate Campaign. The speaker panel took place on the eve of Ford Motor Co.’s third quarter financial statement, with Ford, Volkswagen, and other automakers called on to avoid gutting the clean cars standards by “colluding with President Donald Trump to roll them back.”

administration’s federal fuel economy and emissions standards. U.S. Sen. Sheldon Whitehouse (D-R.I.) was scheduled to participate in a conference call Wednesday with executives from Sierra Club, Environment America, Public Citizen, Greenpeace, and Safe Climate Campaign. The speaker panel took place on the eve of Ford Motor Co.’s third quarter financial statement, with Ford, Volkswagen, and other automakers called on to avoid gutting the clean cars standards by “colluding with President Donald Trump to roll them back.”  Wednesday, in presence of among others the Swedish Prime Minister Stefan Löfven. NEVS (National Electric Vehicle Sweden) is producing electric cars adapted from Saab assets. The company is backed by Chinese investors. The new automaker debuted an electric 9-3 at the 2017 CES Asia trade show. DiDi is China’s largest shared mobility service, and cut Uber out of the market last year through a major investment and no-compete deal. NEVA and DiDi plan to develop an electric vehicle fully optimized to DiDi’s mobility service. That includes going the route of self-driving and on-demand mobility services of the future. It will probably tap into the InMotion concept that NEVS unveiled in June. The first vehicle used in the new cooperative venture will be the NEVS 9-3.

Wednesday, in presence of among others the Swedish Prime Minister Stefan Löfven. NEVS (National Electric Vehicle Sweden) is producing electric cars adapted from Saab assets. The company is backed by Chinese investors. The new automaker debuted an electric 9-3 at the 2017 CES Asia trade show. DiDi is China’s largest shared mobility service, and cut Uber out of the market last year through a major investment and no-compete deal. NEVA and DiDi plan to develop an electric vehicle fully optimized to DiDi’s mobility service. That includes going the route of self-driving and on-demand mobility services of the future. It will probably tap into the InMotion concept that NEVS unveiled in June. The first vehicle used in the new cooperative venture will be the NEVS 9-3. London, Paris, Los Angeles, Copenhagen, Barcelona, Quito, Vancouver, Mexico City, Milan, Seattle, Auckland, and Cape Town have signed the declaration that commits to procuring only zero-emission buses from 2025, and to make sure a major area of their city is zero emission by 2030. Commitments include increasing usage of walking, cycling, public transportation, and shared transport; reducing the number of polluting vehicles on their streets; converting over to ZEVs for their city fleets; and collaborating with suppliers, fleet operators, and businesses to shift over to ZEVs and reduce vehicle miles in these cities. Paris mayor Anne Hidalgo, who led the ban for elimination of fossil fuel-powered vehicles in the city, is serving as C40 chair. “Working with citizens, businesses and mayors of these great cities we will create green and healthy streets for future generations to enjoy,” Hidalgo said.

London, Paris, Los Angeles, Copenhagen, Barcelona, Quito, Vancouver, Mexico City, Milan, Seattle, Auckland, and Cape Town have signed the declaration that commits to procuring only zero-emission buses from 2025, and to make sure a major area of their city is zero emission by 2030. Commitments include increasing usage of walking, cycling, public transportation, and shared transport; reducing the number of polluting vehicles on their streets; converting over to ZEVs for their city fleets; and collaborating with suppliers, fleet operators, and businesses to shift over to ZEVs and reduce vehicle miles in these cities. Paris mayor Anne Hidalgo, who led the ban for elimination of fossil fuel-powered vehicles in the city, is serving as C40 chair. “Working with citizens, businesses and mayors of these great cities we will create green and healthy streets for future generations to enjoy,” Hidalgo said. Seven years after the credit system was initiated for producers of low-carbon fuels, cities and companies are using renewable diesel coming from fats and oils for all types of vehicles, including fire trucks to UPS delivery trucks. Bloomberg reported that the value of the LCFS credits for renewable diesel exceed those from electric vehicles fourfold and are second only to ethanol. The market “is definitely growing,” said Dayne Delahoussaye, head of Neste’s North American public affairs, the largest supplier of renewable diesel in California. “Renewable diesel has become very popular with the refining community as a good tool to meet obligations.”

Seven years after the credit system was initiated for producers of low-carbon fuels, cities and companies are using renewable diesel coming from fats and oils for all types of vehicles, including fire trucks to UPS delivery trucks. Bloomberg reported that the value of the LCFS credits for renewable diesel exceed those from electric vehicles fourfold and are second only to ethanol. The market “is definitely growing,” said Dayne Delahoussaye, head of Neste’s North American public affairs, the largest supplier of renewable diesel in California. “Renewable diesel has become very popular with the refining community as a good tool to meet obligations.” indicating whether an agreement has been met. Those talks were reported to have been underway earlier this year. Tesla would still have to pay the 25% import fee that it’s had all along in China, but the company would have costs reduced not having to ship the cars into that market. It would also allow Tesla to stay true to its identity of being an independent operator by avoiding the traditional joint venture with a Chinese automaker that Tesla’s competitors have been doing for years. China is becoming more flexible to grow its local EV market and remain No. 1 globally, to clean up air pollution in its growing cities, and to free up the nation from foreign oil imports. The electric carmaker has been moving in this direction in recent years, with CEO Elon Musk thinking that it’s the most significant market in the world for company growth. The company now has a 5% stake from Chinse internet company Tencent Holdings, which should support Tesla’s strategy in that market.

indicating whether an agreement has been met. Those talks were reported to have been underway earlier this year. Tesla would still have to pay the 25% import fee that it’s had all along in China, but the company would have costs reduced not having to ship the cars into that market. It would also allow Tesla to stay true to its identity of being an independent operator by avoiding the traditional joint venture with a Chinese automaker that Tesla’s competitors have been doing for years. China is becoming more flexible to grow its local EV market and remain No. 1 globally, to clean up air pollution in its growing cities, and to free up the nation from foreign oil imports. The electric carmaker has been moving in this direction in recent years, with CEO Elon Musk thinking that it’s the most significant market in the world for company growth. The company now has a 5% stake from Chinse internet company Tencent Holdings, which should support Tesla’s strategy in that market. to enable growth in fast charging. It includes electrification projects that will support the development and verification of electric drive systems and infrastructure for what it defines as “extreme fast charging” (400-kW). It’s being done through the DOE’s Vehicle Technologies Office (VTO), which funds early-stage, high-risk research to support improved vehicle efficiency, lowers costs, and increases use of secure, domestic energy sources. It’s part of a VTO-funded report that will be released today, where researchers at Idaho National Laboratory, Argonne National Laboratory, and the National Renewable Energy Laboratory identified technical gaps to bring an extreme fast charging network to the U.S. The

to enable growth in fast charging. It includes electrification projects that will support the development and verification of electric drive systems and infrastructure for what it defines as “extreme fast charging” (400-kW). It’s being done through the DOE’s Vehicle Technologies Office (VTO), which funds early-stage, high-risk research to support improved vehicle efficiency, lowers costs, and increases use of secure, domestic energy sources. It’s part of a VTO-funded report that will be released today, where researchers at Idaho National Laboratory, Argonne National Laboratory, and the National Renewable Energy Laboratory identified technical gaps to bring an extreme fast charging network to the U.S. The  Alphabet’s self-driving driving division, Waymo, created an alliance with Lyft earlier this year on an autonomous vehicle project. Another funding division within Alphabet in 2013 made a $250 million investment in Lyft’s competitor, Uber. That ended badly after Uber entered the world of testing self-driving cars, with a major lawsuit coming from Waymo for allegations of intellectual property theft by Uber. The CapitalG funding round isn’t closed yet. One part of the agreement would be having CapitalG partner David Lawee join Lyft’s board.

Alphabet’s self-driving driving division, Waymo, created an alliance with Lyft earlier this year on an autonomous vehicle project. Another funding division within Alphabet in 2013 made a $250 million investment in Lyft’s competitor, Uber. That ended badly after Uber entered the world of testing self-driving cars, with a major lawsuit coming from Waymo for allegations of intellectual property theft by Uber. The CapitalG funding round isn’t closed yet. One part of the agreement would be having CapitalG partner David Lawee join Lyft’s board. certification from the California Air Resources Board’s On-Road New Vehicle and Engine Certification Program. The company’s 8L V8 fuel-injected engine achieved a NOx emission value less than 0.02 g/bhp-hr, which meets the optional near-zero NOx level set by CARB, on three different fuels: LPG, CNG and gasoline. The Greenkraft 8L spark-ignited engine is among the first to be certified at this near-zero NOx level on three different fuels, according to Greenkraft. It’s available as a stand-alone product, or it can be installed ln one of Greenkraft’s 26,000 GVW or 33,000 GVW heavy-duty trucks.

certification from the California Air Resources Board’s On-Road New Vehicle and Engine Certification Program. The company’s 8L V8 fuel-injected engine achieved a NOx emission value less than 0.02 g/bhp-hr, which meets the optional near-zero NOx level set by CARB, on three different fuels: LPG, CNG and gasoline. The Greenkraft 8L spark-ignited engine is among the first to be certified at this near-zero NOx level on three different fuels, according to Greenkraft. It’s available as a stand-alone product, or it can be installed ln one of Greenkraft’s 26,000 GVW or 33,000 GVW heavy-duty trucks. market this year. During September, the market saw 59,000 plug-in vehicle sales, up 80% over September 2016. Year to date, China had 338,000 units sold, up 48% over the first nine months of 2016. Battery electric and plug-in hybrid vehicles made up 1.8% of new vehicle sales in the market, up from 1.5% a year ago. The top five sellers during September, in rank order, were the BAIC EC-Series, the Zhidou D2 EV, the BYD Song PHEV, BYD Qin PHEV, and Chery eQ. BYD took 19% of the “new energy vehicle” sales for the month, beating former leader BAIC, which had 15% of the share.

market this year. During September, the market saw 59,000 plug-in vehicle sales, up 80% over September 2016. Year to date, China had 338,000 units sold, up 48% over the first nine months of 2016. Battery electric and plug-in hybrid vehicles made up 1.8% of new vehicle sales in the market, up from 1.5% a year ago. The top five sellers during September, in rank order, were the BAIC EC-Series, the Zhidou D2 EV, the BYD Song PHEV, BYD Qin PHEV, and Chery eQ. BYD took 19% of the “new energy vehicle” sales for the month, beating former leader BAIC, which had 15% of the share. need more power to get to a charging station. The patent granted to the tech giant also includes a rooftop docking station that the drone can land on to stay connected with the EV and provide power while it continues the trip. It would mean working directly with automakers to be adaptable to the technology, or making aftermarket modifications. The product isn’t scheduled to be launched anytime soon, but it ties into Amazon’s overall strategy tied to drone delivery services. The company could see demand for the product, with sales of EVs increasing each year.

need more power to get to a charging station. The patent granted to the tech giant also includes a rooftop docking station that the drone can land on to stay connected with the EV and provide power while it continues the trip. It would mean working directly with automakers to be adaptable to the technology, or making aftermarket modifications. The product isn’t scheduled to be launched anytime soon, but it ties into Amazon’s overall strategy tied to drone delivery services. The company could see demand for the product, with sales of EVs increasing each year. in hybrid is scheduled to roll off the production line in mid-2019. It’s a two-door, 2+2 seat coupe with an ‘Electric Performance Hybrid’ drivetrain capable of going about 93 miles on battery power. That could be less in the U.S., with Polestar not specifying whether range is based on European or U.S. standards. If it is 93 miles, it would be the longest range plug-in hybrid electric vehicle on the market. It will have a lot of power, with an output of 600 horsepower and 1000 Nm of torque, appealing to the high-performance car buyer. It will be built on Volvo’s Scalable Platform Architecture (SPA) but approximately 50% is new and created by Polestar’s engineers. A carbon fiber body reduces bodyweight. The company confirmed plans are in place for three Polestar models to be built at a production facility in China. Polestar 2 will be a battery electric vehicle, mid-sized to compete with the Tesla Model 3. It’s slated to start production in late 2019 and will have higher production volumes than the Polestar 1.

in hybrid is scheduled to roll off the production line in mid-2019. It’s a two-door, 2+2 seat coupe with an ‘Electric Performance Hybrid’ drivetrain capable of going about 93 miles on battery power. That could be less in the U.S., with Polestar not specifying whether range is based on European or U.S. standards. If it is 93 miles, it would be the longest range plug-in hybrid electric vehicle on the market. It will have a lot of power, with an output of 600 horsepower and 1000 Nm of torque, appealing to the high-performance car buyer. It will be built on Volvo’s Scalable Platform Architecture (SPA) but approximately 50% is new and created by Polestar’s engineers. A carbon fiber body reduces bodyweight. The company confirmed plans are in place for three Polestar models to be built at a production facility in China. Polestar 2 will be a battery electric vehicle, mid-sized to compete with the Tesla Model 3. It’s slated to start production in late 2019 and will have higher production volumes than the Polestar 1. claims it can be refueled at a hydrogen station within three minutes, and will have 1,000 kilometers (620 miles) of driving range. That would be double the U.S. rating of 312 miles of range for the Toyota Mirai; however, Toyota said that the 1,000 km range rating is based on Japan’s JC08 test cycle, which would likely be farther than the U.S. rating. The concept car will also come with artificial intelligence and automated driving features, Toyota said. The “premium saloon” will have room for six passengers. The seat layout can be flexibly adjusted to make the vehicle as comfortable and user-friendly as possible.

claims it can be refueled at a hydrogen station within three minutes, and will have 1,000 kilometers (620 miles) of driving range. That would be double the U.S. rating of 312 miles of range for the Toyota Mirai; however, Toyota said that the 1,000 km range rating is based on Japan’s JC08 test cycle, which would likely be farther than the U.S. rating. The concept car will also come with artificial intelligence and automated driving features, Toyota said. The “premium saloon” will have room for six passengers. The seat layout can be flexibly adjusted to make the vehicle as comfortable and user-friendly as possible. discussions from Oct. 9-11. Overall, about 9,500 people have been in attendance as participants and trade fair visitors. Panelists and those visiting exhibits have been discussing the future of mobility at the 30th EVS. The mood was positive, and discussions focused on the next phase of the EV industry’s future coming together this year. “Technological prerequisites have been created and some electrification products are already available, as demonstrated by the 353 exhibitors…….” according to conference planners.

discussions from Oct. 9-11. Overall, about 9,500 people have been in attendance as participants and trade fair visitors. Panelists and those visiting exhibits have been discussing the future of mobility at the 30th EVS. The mood was positive, and discussions focused on the next phase of the EV industry’s future coming together this year. “Technological prerequisites have been created and some electrification products are already available, as demonstrated by the 353 exhibitors…….” according to conference planners.