There’s quite a lot to follow lately with used electric vehicle prices dropping, and changeovers taking place at Rivian and Fisker.

For over a dozen years now, automakers have been producing electric vehicles on assembly lines in the U.S. — starting with the Nissan Leaf, Chevrolet Volt, and Tesla Model S. Other EVs had been rolling out in smaller numbers prior to that time, too, including the Mitsubishi i-MiEV and Tesla Roadster. But it would take a few years to see new battery electric and plug-in hybrid models launched from established OEMs and post-startups. EV sales would at first see impressive gains for the Tesla Model 3 and Model Y, and later from competitors.

Some of these models, such as the Chevy Volt and i-MiEV plus several commercial electric trucks and vans, have been pulled from the market. Automaker have had a difficult goal to meet: making EV models profitable and realistically tied to market demand and innovations.

Plug-in electric vehicles only make up about 1% of the total light-duty vehicles on U.S. roads, but the number is large enough to track its impact on used vehicle market values; and other parts of vehicle lifecycle analysis. The number went up to about 3.3 million units at the end of 2023 — up from 2 million in 2022 and 1.3 million in 2021, according to Experian Automotive Market Trends report.

Used electric vehicle values had stayed strong over these years, with limited volume on the market and enough car shoppers fascinated with the new technology to pay more for a used EV than a used gasoline-powered car. Things started changing earlier this year. Hertz announced it would sell 20,000 EVs, mostly the Tesla S. They would be replaced by gasoline-powered cars. The car rental giant also put a hold on an order for 65,000 battery-powered cars made by Polestar.

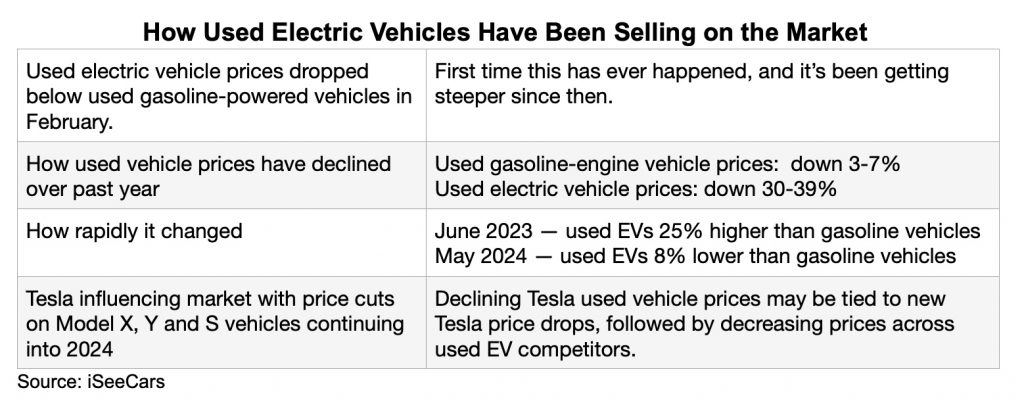

In February, used EV prices fell below average gasoline-powered cars for the first time ever. That market trend has continued, with car search engine and sales channel iSeeCars analyzing 2.2 million 1- to 5-year-old used cars in May 2023 compared to May 2024. The company recently found that the average used EV price came in at $28,767, or 8.3 percent below the average gas car at $31,424. Compare that to one year earlier when the average used EV cost $40,783 and the average used gasoline-powered car cost $33,469, according to iSeeCars data.

What are some of the factors impacting used EV prices? “It’s clear used car shoppers will no longer pay a premium for electric vehicles and, in fact, consider electric powertrains a detractor, making them less desirable – and less valuable – than traditional models,” said Karl Brauer, executive analyst at iSeeCars.

Comparing Tesla Model 3 prices the BMW 3 Series sheds some light on this issues, according toe iSeeCars. A used Tesla Model 3 was priced $2,635 above a BMW 3 Series in June 2023. By May 2024 the Model 3 was priced $4,806 below the 3 Series.

The Tesla Model Y had a $4,570 price premium over the X3 in January 2024, but that difference fell to only $175 by May 2024.

Some of the other factors impacting used EV valuation includes consumer concern over EV battery life; the growing volume of used EVs coming to market; and consumer showing less willingness to pay a premium for EVs. It’s also taking place during a time when the overall U.S. used vehicle market has been seeing a downturn since late 2023.

What’s happening with EV makers?

As we’ve been observing over the past dozen-plus years, the auto market is a very tough one to break into — with EVs and their expensive battery packs being part of the challenge in being viable and profitable. Incentives like federal tax credits and state rebates have helped drive demand for these vehicles, but they’ve reached a mass-production level that’s typical of all segments of new and used vehicles on American roads.

Here’s some new developments that have come up for three significant players in the EV market…….

Rivian: Volkswagen is putting about $5 billion into Rivian in exchange for stock and the right to use Rivian’s EV and software technology through a joint venture. The startup company had paused plans in March to open up a new manufacturing plant in Georgia. Rivian had taken losses of about $39,000 per vehicle built last quarter.

Fisker: Fisker filed for bankruptcy protection last week, as the EV maker began selling assets and restructuring its debt. That was after burning through cash in an attempt to ramp up production of its Fisker Ocean SUV model. Other EV makers have gone through BK protection in the the past two years as well, including Proterra, Lordstown and Electric Last Mile Solutions. Demand had been lower than expected, and finding investment backers became difficult along with having its supply chain needs met during a disruptive period. Henrik Fisker and team were unable to secure an investment from a major automaker, which lead to filing for BK.

BYD: Berkshire Hathaway is reducing its share in Chinese EV giant BYD — from a little bit over 7% to a little under 6%. Owning shares of the company started for BH in 2008 with $230 million for about 225 million shares, which came out to around a 10% stake. Last year, the automaker beat Tesla for the first time ever in global EV sales. Tesla took the title back in the Q1 of this year.

And in other news………

Ford in Long Beach: Ford Motor Co. is setting up a research-and-development team to work on the company’s next generation of electric vehicles. It will soon be headquartered in Douglas Park, adjacent to Long Beach Airport, Mayor Rex Richardson and Ford announced yesterday. “Long Beach is a key part of our broader strategy to attract top talent to develop future vehicles and experiences for our customers,” Doug Field, Ford’s chief EV, digital and design officer, said in a statement.

The automaker said that campus will open up in early 2025. It will include two buildings and eventually accommodate up to 450 employees working on designing “a low-cost, flexible electric vehicle platform.” Led by former Tesla executive Alan Clarke, this R&D center had already gained attention from scooping up engineering talent from other electric car manufacturers like Rivian. Ford’s history in the area goes way to 1930, when the Ford Long Beach Assembly Plant began building Model A’s on a plot of land just north of Terminal Island.

BYD school bus: The Creator, the BYD RIDE’s newest zero-emission Type C school bus, will be rolling out at the STN Reno event July 12-17. The Creator is backed by a 12-year battery warranty and offers a seating capacity of up to 78 students. The Type C has a range of up to 208 miles and has the option to include up to two wheelchair positions.