Electrified trucks and buses, the significance of renewable natural gas, and growing interest among users in mobility services and automated transport, were leading topics at ACT Expo 2017 in Long Beach, Calif. The exhibit hall was filled with the latest clean vehicles, drivetrain components, and fueling infrastructure dispensers and stations available to the fleet market.

Electrified trucks and buses, the significance of renewable natural gas, and growing interest among users in mobility services and automated transport, were leading topics at ACT Expo 2017 in Long Beach, Calif. The exhibit hall was filled with the latest clean vehicles, drivetrain components, and fueling infrastructure dispensers and stations available to the fleet market.

Electrified vehicles: While several prominent electric work truck makers went out of business not too long ago, fleets now have a diverse selection of offerings to choose from companies that look ready to stay on the market and service the vehicles long-term. Vehicles include buses, shuttles, port drayage trucks, work pickup trucks, and delivery trucks.

Workhorse Group unveiled its W-15 electric concept pickup. It can go 80 miles per charge through its 60 kWh battery pack. Buyers can also pay for an extended range plug-in hybrid version that can go a total of 310 miles on electricity and gasoline. As reported in Green Auto Market, the company is seeing a lot of interest in the market, with letters of intent received for the purchase of 3,000 units from a few utility and government fleets. It has a starting price of $52,000 and its platform was built on the E-Gen electric technology used in Workhorse medium-duty delivery trucks. Along with emissions reduction benefits, the company said it the W-15 has 460 horsepower with the ability to carry 2,200 pounds in payload and tow 5,000 pounds.

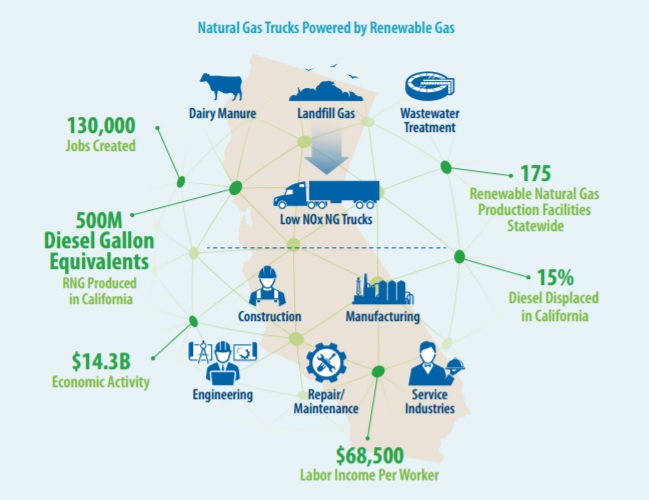

Renewable natural gas: One fleet manager told me how RNG has been taking off in California for municipal fleets, with major gas suppliers now offering the clean fuel and state incentives backing it. His natural gas used in the fleet has been made up of about half traditional natural gas and half RNG. The Coalition for Renewable Natural Gas and the California Natural Gas Vehicle Coalition released a study forecasting the economic impact RNG is bringing to the state. Deploying trucks fueled by renewable natural gas could create up to 130,000 new jobs and add $14 billion to California’s economy. The ‘RNG Jobs Report’ says that a switch to renewable natural gas trucks could quickly help California achieve its air quality, greenhouse gas emissions, and climate change-related goals.

Award winners: Fleet Owner’s Green Fleet of the Year: Walmart. The company, with its huge fleet of 6,400 tractors and 61,000 trailers, has seen several sustainability innovations adopted since Hurricane Katrina in 2005. Like several transport companies and vehicle makers, the strategy has been corporate-wide, with fleet vehicles on part of it. Recently, 75% of Walmart’s global waste is diverted from landfills and 25% of its operations are powered by renewable energy sources. Since setting its sustainability targets in 2005, the company has removed about 35 million metric tons of carbon emissions from its supply chain despite its continuing growth over that time period.

ACT Expo awards:

Leading Carrier Fleet: Saddle Creek Logistics Services. The carrier has 550 tractors with 250 of them powered by CNG moving through the southeast U.S.

Utility Fleet: ForticBC. The British Columbia electric power and gas distribution utility now operates about 600 CNG and LNG heavy duty vehicles. The goal is bringing the fleet up to 50% alternative fuels by the end of 2018. The utility operates 15 CNG and seven LNG fueling stations.

Transit & Mobility Fleet: North Kansas City School District. So far, 159 Type C school buses have been converted to run on CNG.

Private Fleet: Frito-Lay, Inc. The company currently has 580 CNG freight trucks, 17 CNG public fueling stations, and 200 electric vehicles; that makes for the largest commercial EV fleet in the U.S.

Public Fleet: City of Los Angeles. The city reported that 2,041 of its vehicles have been displaced from traditional internal combustion engine vehicles. The fleet is now made up of hybrid vehicles, CNG street sweepers, LNG and CNG refuse trucks, 143 LNG and CNG heavy-duty trucks, and 100% of LA DOT’s buses are green.

“In It For the Long Haul” award: Waste Management, Inc. The company reported having 5,791 of its collection vehicles running on natural gas. It has 95 CNG, LNG, and liquefied compressed natural gas (LCNG) fueling stations in place. About 40% of its natural gas vehicles are fueling by renewable natural gas coming from landfill biogas.

GM’s take on mobility: General Motors is in a strong position to experience firsthand transportation trends of the next decade. In an interview, Alex Keros, manager and senior project engineer for Maven and GM, talked about what’s working with the Maven carsharing unit since GM launched it last year. About 60% to 70% of renters are members of the millennial generation who have less interest in owning a vehicle but do need to become acclimated to mobility options. GM is also in a good position to analyze data on the ridesharing side of the business through its investment in Lyft, which is also part of testing out self-driving Chevy Bolts. Lyft drivers and Maven renters are trying out driving the Bolt and the Chevy Volt. It’s turning into an excellent learning experience for users; the Lyft drivers are playing a role in sharing their experience with Lyft riders on what it’s like to drive an electric car. They’re not hearing complaints about the limited range issue, which has to do with the Bolt’s 238 miles and the Volt’s extended range. Even more important, Keros said, is drivers learning how to live with and respect the technology. They do adapt quickly to electrified mobility, he said. The company is working with EVgo on getting drivers set up to charge in their network. That’s also part of the learning experience with drivers finding out how long it takes; and how you can get away with taking a shorter charge to make a short trip, and then doing a full charge at night. Doing less than a 100% full charge is typical, he said.

In a separate interview, Mustafa Mohatarem, chief economist for GM, said that he doesn’t expect to see surging growth in ridesharing firms Lyft and Uber, and carsharing through Maven and Zipcar, along with the introduction of autonomous vehicles, to mean we’ll see a lot less vehicles on roads in the next 10 years. With drivers of these shared rides putting 25,000 to 50,000 miles per year on their cars, it will accelerate the replacement cycle, he said. Car sales aren’t likely to drop significantly.

Mohatarem doesn’t see EV sales skyrocketing in the near future. While diesel cars are going away in Europe since the Volkswagen scandal started, traditional engine vehicles won’t be going away anytime soon. With development of U.S. shale reserves, the supply will be plentiful and domestic for the foreseeable future, he said. Regulatory pressure in markets like Europe is a factor that will bring more EVs to market, he said. The chief economist doesn’t see EVs becoming viable until they make up at least 10% of new vehicle sales.

GM does see demand for natural gas and propane autogas vehicles growing among fleets. It’s also driven by overall fuel prices. Both of the alternative fuels are seeing a wider product range, which is helping with vehicle sales. The automaker is seeing demand for CNG-powered versions of the Chevy Equinox and Cruze and its pickup truck lineup. Good range and strong fuel economy are helping, Mohatarem said.

Cap and trade funds: The California Air Resources Board announced at ACT Expo that California Climate Investments in zero-emission vehicles have reached $599 million since 2013. That’s supported putting hundreds of thousands of clean cars and zero-emission trucks and buses on California roads. That’s come from 115,000 light-duty zero emission vehicles including battery electric, plug-in hybrids, and fuel cell vehicles. On the commercial truck side, 46 Class 7 and 8 zero-emission trucks; 950 electrified delivery, utility, and refuse trucks; 407 zero emission transit buses, shuttles, and light-rail cars; 29 electric school buses; and 46 zero emission off-road vehicles, have received cap-and-trade funding from the state. Capital comes from the quarterly cap-and-trade auctions that came from the state’s AB 32 global warming law enacted in 2006. Some of the investment has supported demonstration projects of various specialty vehicles serving the ports and other applications.

And in other ACT Expo news………

- BYD showcased its class 8 battery electric refuse trucks, which the company said is the first heavy-duty refuse truck built by an original equipment manufacturer that’s 100 percent battery electric. The Chinese automaker said that its North American division now offer these vehicles for purchase and delivery. BYD also announced that its first 60-foot articulated battery electric transit bus has been delivered to Antelope Valley Transit Authority. It’s part of the Los Angeles county-based transit agency’s goal to convert its bus fleet to electrification by 2018, and is the first of 13 60-foot electric buses that will end up with the transit agency.

- Cummins Westport will make a new launch of near zero emissions vehicles in 2018, according to president Rob Nietzke. All three of its engines – the 6.7, 8.9, and 11.9 liter versions – will be renamed next year and will feature refinements from the Near Zero design launched in 2015. The 8.9-liter L9N and the ISX12N will be certified by CARB at just 0.02 grams of NOx per brake-horsepower hour, which is 90% cleaner than the current standard. The 6.7-liter B6.7N is to be certified at 50% cleaner than the current standard.

- UPS will deploy a prototype fuel cell electric vehicle in its Rolling Laboratory fleet. UPS is working with the U.S. Department of Energy and other partners to design a first-of-its-kind, zero tailpipe emissions, Class 6 medium-duty delivery truck that meets the same route and range requirements of UPS’s existing conventional fuel vehicles. Unlike fuel cell auxiliary power units, this vehicle will use the onboard fuel cell to generate electricity to propel the vehicle. This project is an important step toward demonstrating the commercial viability of zero tailpipe emissions trucks to fleet operators and the developing FCEV supply chain, the company said.

- Ryder System will be the strategic service partner for Workhorse Group. Ryder will be the exclusive maintenance provider for Workhorse’s entire light- and medium-duty range-extended electric vehicle fleet in North America and will provide a combination of warranty and maintenance services as part of Ryder’s SelectCare fleet maintenance portfolio. Ryder will also serve as the primary distributor in North America for Workhorse’s E-100 and E-GEN range-extended medium-duty vehicles, as well as the new W-15 electric pickup truck.

There’s a lot happening right now as the largest port in the U.S. moves farther toward clean transportation.

There’s a lot happening right now as the largest port in the U.S. moves farther toward clean transportation.

Lyft partners with Waymo: Ride-hailing firm Lyft has forged a partnership with the Waymo self-driving car firm. The

Lyft partners with Waymo: Ride-hailing firm Lyft has forged a partnership with the Waymo self-driving car firm. The  If you take a

If you take a  Starting tomorrow, Green Auto Market will be emailed out to readers daily. News coverage will be shared along with a central topic for the day significant in clean transportation.

Starting tomorrow, Green Auto Market will be emailed out to readers daily. News coverage will be shared along with a central topic for the day significant in clean transportation. Challenging EPA cuts: President Donald Trump’s

Challenging EPA cuts: President Donald Trump’s  Low emission NGVs and fuels highlighted at ACT Expo: A

Low emission NGVs and fuels highlighted at ACT Expo: A  If you

If you