It looks like E10 could very well remain the blended ethanol-to-gasoline ratio instead of 15%, or E15, according to a leaked proposal last week from the US Environmental Protection Agency (EPA). If that’s the case, courts are likely to see more case filings coming from biofuels industry associations focused on the EPA backing away from 2014 targets. The oil industry had already filed two suits over 2013 targets. The EPA document referred to the E10 blend wall as an “important reality” and comes from more acceptance that the federal 2007 Renewable Fuel Standard biofuels mandate appears to be unreachable. If it gets approved, the EPA proposal would cut the biofuel mandate in 2014 to 15.21 billion gallons from 18.15 billion gallons. The EPA only has a draft proposal and has not made a final decision on it, according to administrator Gina McCarthy. EPA also considered a corn-based ethanol rate of 12.36 billion gallons and 13.18 billion gallons.

It looks like E10 could very well remain the blended ethanol-to-gasoline ratio instead of 15%, or E15, according to a leaked proposal last week from the US Environmental Protection Agency (EPA). If that’s the case, courts are likely to see more case filings coming from biofuels industry associations focused on the EPA backing away from 2014 targets. The oil industry had already filed two suits over 2013 targets. The EPA document referred to the E10 blend wall as an “important reality” and comes from more acceptance that the federal 2007 Renewable Fuel Standard biofuels mandate appears to be unreachable. If it gets approved, the EPA proposal would cut the biofuel mandate in 2014 to 15.21 billion gallons from 18.15 billion gallons. The EPA only has a draft proposal and has not made a final decision on it, according to administrator Gina McCarthy. EPA also considered a corn-based ethanol rate of 12.36 billion gallons and 13.18 billion gallons.

Days prior to the leak, two US oil industry groups had sued the EPA over its 2013 biofuels target. Ethanol groups were ready to sue over any changes to the 2014 rule. The Renewable Fuels Association said it would sue over any attempts to roll back the targets – if the EPA does issue its revised 2014 target, biofuels groups appear ready to file lawsuits.

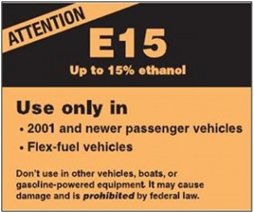

The clash comes down to industries fighting over falling profits – biofuels companies are depending on increasing output and delivering ethanol to gas stations, and oil companies and refineries are fighting the increased cost of adding more ethanol to gasoline. The oil industry is also upset with the soaring cost of ethanol credits built into the Renewable Fuel Standard. While the EPA has ruled that gasoline blended with E15 is safe to use in vehicles made after the 2001 model year, many automakers are refusing to allow their vehicle warranties to cover the use of fuel over E10. Gas station owners don’t want to invest in another storage tank and pumps to provide E15.

Why I disagree with Forbes article on Pickens and Clean Energy pulling a scam

Forbes staff writer Christopher Helman says the launch of Clean Energy Fuel’s “Redeem” renewable natural gas is a bit of a scam. Read his article “The Clever Gimmicks Behind T. Boone Pickens’ New ‘Green’ Fuel” for details. The commentary states that while the company is gathering landfill gas from dump operators across the country and two of its own, it’s just a marketing gimmick that comes out of selling carbon credits like the one being implemented by the California Air Resources Board. Helman wrote that the natural gas is,” simply injected into the nation’s natural gas pipeline grid, where it’s intermingled with all the other conventional gas flowing down the pipes to plants that turn it into CNG…. The ultra-green nature of Redeem is really just an accounting gimmick. The more gas that Clean Energy’s traders can procure from landfills (as well as methane-rich wastewater plants and dairies) across the country, the more CNG it can slap with the Redeem label. But on the molecular level, it’s exactly the same stuff.”

Well here’s my take on it: For anyone interested in buying Redeem, such as a fleet with stringent sustainability targets, there would probably be interest. It costs the same as natural gas. It would have the same GHG/carbon reduction benefit as natural gas – around 20% to 25% less than diesel. Natural gas has another benefit in air pollution reduction – 90% less NOx in natural gas compared to gasoline/diesel. There would also be the part about tapping into landfill for the natural gas. If you were a corporate or government fleet, you could say you’re contributing to reducing our landfill problem and using clean fuel. Plus, you get credits from California Air Resources Board. Helman also makes a comment about it costing 50 cents less than gasoline and diesel. If that’s per gallon equivalent, he was way off – natural gas is sold for only about one third the cost, or around $1.25 or more per gallon – much more than 50 cents in savings.

Another interesting point was seeing a statement by Energy Vision, an energy advocacy group in Washington that tends to hold the natural gas vehicle industry accountable….“By capturing and refining the biogases generated from a number of large landfills across the country, one of which is the Sauk Trail Hills landfill in Michigan, which is owned and operated by Republic Services, Clean Energy will provide approximately 15 million gallons of ultra-low-carbon “Redeem” (RNG) this year alone, a volume far greater than most (including the EPA) estimated was possible nationally, let alone in California. Energy Vision commends the pioneering efforts of Clean Energy/Clean Energy Renewable Fuels in making the path to fully-sustainable renewable natural gas a reality.”

Green transportation news roundup:

- Los Angeles-based MPG Car Rental is now offering the Toyota Model S to renters for $499.99 per day. MPG Car Rental prominently displays other vehicles in its green-only lineup including the BMW i3, Volkswagen Jetta TDI, Chevy Volt, Honda Insight, Toyota Camry Hybrid, Toyota Prius, Toyota Highlander Hybrid, and Chevy Tahoe Hybrid.

New book follows the money trail shaping renewable energy – Plus, a very surprising prediction of stance Obama will take on Keystone XL pipeline

“Do you get the feeling that the energy industry and the Congress that it owns are deliberately lying to you? If so, you are 100% correct,” according to an announcement that 2GreenEnergy.com Editor Craig Shields just had his third book published, Renewable Energy: Following the Money. The book features another set of interviews; the effects that economics and financial power have on the course of the energy industry are explored by high-ranking officers in the US military, lobbyists, scientists, economists, environmentalists, journalists, and heads of NGOs. I applaud Shields’ hard work and wide ranging perspectives on renewable energy and clean transportation. I admire how much he’s kept his word on staying in the trenches on where all of this is going as a business – whether that be through attending key conferences or interviewing experts of all genres for his books and blog. This new book digs into what I would describe as what “Deep Throat” ex-FBI official W. Mark Felt kept telling reporter Bob Woodward about the Watergate scandal: “Follow the money trail.”

Shields also wrote a surprising blog post on the Keystone XL pipeline and President Obama’s decision on whether to back or reject supporting the pipeline from Alberta to Texas. Here’s a few reasons why he thinks it’s going in that direction….

Smart transportation explored in market report and Toronto conference

Navigant Research issued a report on “smart transportation” covering global smart city projects around the world. This came out soon after the annual Meeting of the Minds took place in Toronto last month. Meeting of the Minds has been bringing together urban sustainability and connected technology stakeholders since 2007. Navigant Research thinks the global smart city technology market will grow from $6.1 billion in revenue last year to $20.2 billion by 2020. New projects include investment in smart grid, urban mobility, water management, and government service applications for smart cities. Forecasters see urbanization as a major trend around the world impacting transportation in significant ways.

More skepticism about alternative technology vehicles from industry bible

What an Automotive News video had to say about tough sales challenge cars like Tesla Model S, Chevy Volt and Toyota Prius have on market…. Stop start, micro-hybrids, and regenerative braking are taking away the strength of plug-ins and hybrids.

Solazyme just took top spot for the third year in a row on Biofuels Digest’ “50 Hottest Companies in Bioenergy” for 2013-14. Propel Fuels (provider of biofuels and other alternative fuels refueling stations) made the list for the first time at No. 29. Solazyme produces renewable oil and bioproducts from a range of plant-based sugars. The company is providing algae diesel with Propel Fuels. Cellulosic biofuel producer KiOR made No. 3 on the top 50 list. The annual rankings recognize innovation and achievement in biobased chemicals and materials development; it’s based 50% on votes from an invited panel and the other 50% from readers – more than 100,000 individual company ratings were received from panelists and voters.

Even if the “leaked” document becomes reality, there is no reason to believe that E15 expansion won’t continue. E15 is higher octane at a lower price. Most retailers do not have to install new equipment to offer E15. In fact, of the E15 stations open today, not a one did. Ethanol is, and has been, much cheaper than gasoline. If the RVOs are lowered, that will definitely not change, and independent retailers will keep marching forward as they strive to add more to their bottom line and lower the price to consumers at the same time.