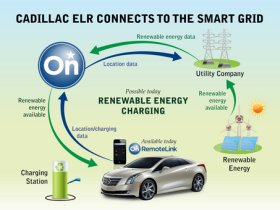

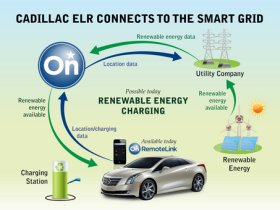

Luxury extended range cars: Extended range, plug-in hybrids will see their next luxury models hit the market next year. The Fisker Karma was the first one, but those sporty luxury cars have been out of production for quite a while now. The two models to watch in 2014 will be the Cadillac ELR and the BMW i8. The 2015 Cadillac ELR will start showing up in January at dealer lots and will start at $75,955. The 2014 BMW i8 will go for $135,625, including a $925 destination charge, when it shows up in the US during the spring season. They’ll be competing with the Tesla Model S, BMW i3, and later in the year, Tesla Model X crossover, all of which are battery electric vehicles. The extended range models are pricy even after federal tax credits and state incentives but offer the benefit Fisker has been selling – reduced range anxiety. Their production volumes will be limited, but GM and BMW have a lot of experience in successfully making and marketing luxury models.

Luxury extended range cars: Extended range, plug-in hybrids will see their next luxury models hit the market next year. The Fisker Karma was the first one, but those sporty luxury cars have been out of production for quite a while now. The two models to watch in 2014 will be the Cadillac ELR and the BMW i8. The 2015 Cadillac ELR will start showing up in January at dealer lots and will start at $75,955. The 2014 BMW i8 will go for $135,625, including a $925 destination charge, when it shows up in the US during the spring season. They’ll be competing with the Tesla Model S, BMW i3, and later in the year, Tesla Model X crossover, all of which are battery electric vehicles. The extended range models are pricy even after federal tax credits and state incentives but offer the benefit Fisker has been selling – reduced range anxiety. Their production volumes will be limited, but GM and BMW have a lot of experience in successfully making and marketing luxury models.

Pricing: MSRP pricing for electric vehicles dropped in the first half of 2013 to the extent that the “price war” label could be applied for the first time. I would expect to see more of that happen including the cost of buying a Level 2 charger and having it installed in your garage. Multi-unit Level 2 chargers installed in parking garages, condos, and workplaces, are becoming a little bit more cost competitive, too. Converting business vehicles over to natural gas or propane may take a while to see a significant price drop – it’s still small in transaction numbers. Perhaps seeing more pickup trucks from the Big 3 with those alternative fuel options will push the cost down in a more competitive marketplace.

Connectivity: Seamless and simple connectivity between the smartphone and dashboard is expected by car owners today and has huge potential for improving the driving experience – such as not getting lost and making the trip more fuel efficient. It also has a lot to do with finding the right charging stations and alternative fuel spots – ones that actually work and will accept your payment method.

Responding to a crisis as an opportunity: Check out this blog post by Roger Lanctot, associate director, automotive practice, at Strategy Analytics. He makes the point that Tesla’s software update after its Model S battery fires tells a story about the issues automakers are facing on responding to customer perceptions and working with their dealer networks. Tesla was able to announce a software update to raise the speed at which the car automatically lowers itself by an inch for better aerodynamics. Other automakers, including Chrysler and Toyota, can provide their customers with software updates via smartphones for app updates and installation. This has happened despite dealer resistance. Lanctot, who led a speaker panel in November at Connected Car Expo, makes the point that GM (and OnStar) and other OEMs could do well to learn something from Tesla’s solution for software updates and the marketing points the automaker can score (and, I would say, customer retention). I would also say that turning problems into opportunities is there for every clean transportation technology – finding enough alternative fueling and charging stations, lithium battery durability, range anxiety concerns, dependability of the engine while using the alternative fuel, bringing a new fuel or powertrain into the fleet, and justifying the investment.

Lightweighting: For automakers in the US and Europe to meet ambitious government mandates on fuel efficiency and carbon emissions, ligthweighting the vehicles is being tried out – bringing in more magnesium alloys (BMW), aluminum (Ford in the next F-150 pickup), and using more plastics (every OEM) being clear examples. The biggest concern has been safety – metal might be heavier than its alternative, but it’s more likely to retain its structure during a collision or once the vehicle is weighted down with a lot of cargo. Government safety standards are more stringent these days, but there needs to be more confidence in the testing procedures.

Infrastructure: It’s the classic quandary in clean transportation. Will people really buy enough of these green vehicles to turn a profit? Is there enough alternative fueling and charging infrastructure to alleviate their range anxiety? The numbers are getting better (as readers of the monthly Green Auto Market Extended Edition can confirm – where stats on charging and fueling stations are reported each month). One of the ways this is seeing improvement is through local market alliances, many times organized by Clean Cities coordinators. Infrastructure suppliers play a key role, too. In this Green Auto Market interview, Schneider Electric’s Mike Calise talked about an alliance bringing together stakeholders such as employers, a carshare service, Schneider Electric, and Toyota to set up train stations with EV charging, carsharing, and bike stands. The concerns of community stakeholders have to be addressed and integrated within the infrastructure planning to get the necessary buy-in.

A few other points to make. Don’t write off biofuels in the wake of the EPA’s Renewable Fuel Standard decision. Or with concern over the economic viability of the fuel, or whether environmental concerns offset their advantages. Check out Biofuels Digest – you may be astonished at how big advanced biofuels are becoming as an industry and what investors think about it. A lot of it has been going on outside of transportation, but that’s starting to change. Carsharing and van pooling are starting to take off in the US – Zipcar, City CarShare, Enterprise CarShare, Hertz 24/7, and Car2go (a Daimler subsidiary) are expanding in several markets, and I’m starting to see a lot more van pooling services out on the roads. Fleet managers are extremely important stakeholders and decision makers to follow. Pay attention to what Claude Masters, NAFA’s president, is up to including organizing workshops with CALSTART. Fleet management companies (such as ARI, PHH Arval, GE Capital Fleet Services, Wheels, Enterprise Fleet Services, and Donlen) are offering fleets more services in sustainability, clean transportation, and alternative fuel vehicles.

Settlement of the Fisker Automotive bankruptcy and bidding for new ownership continues to be dragged out – but the Delaware plant may survive. Hybrid Technology, led by billionaire Richard Li, has put in $55 million for Fisker’s assets. Hybrid’s bid had been rejected days ago by bankruptcy court judge Kevin Gross. Hybrid is offering $30 million in cash and is willing to cancel $25 million in debt that Fisker owed the Chinese company. Hybrid also is offering $5.5 million to unsecured creditors if they would agree to back Hybrid Technology instead of its rival, Wanxiang Group.

Settlement of the Fisker Automotive bankruptcy and bidding for new ownership continues to be dragged out – but the Delaware plant may survive. Hybrid Technology, led by billionaire Richard Li, has put in $55 million for Fisker’s assets. Hybrid’s bid had been rejected days ago by bankruptcy court judge Kevin Gross. Hybrid is offering $30 million in cash and is willing to cancel $25 million in debt that Fisker owed the Chinese company. Hybrid also is offering $5.5 million to unsecured creditors if they would agree to back Hybrid Technology instead of its rival, Wanxiang Group.