The use of robotics in vehicle manufacturing will continue to grow at a fast enough pace to speed up production — and to remove quite a lot of jobs. Of course, job loss is nothing new in auto manufacturing where downsizing plants and moving some of them overseas has been taking place since the 1980s.

For the auto industry, it all started with General Motors testing out prototype spot welding robots in 1961. By the 1980s, billions of dollars were being spent by automakers worldwide to automate fundamental tasks in their assembly plants. Automation system deployment did decline in the 1990s, but innovative technology did help it to rebound in the next decade.

Today, it’s a common part of factories, and it’s starting to become another revenue source for automakers through providing robotic services to other companies. These companies are selling the advantages of protecting workers from injuries and making factories more efficient and streamlined by bringing in the best of robotics. There’s also the point about making the job less repetitive and boring for workers, which could also help improve retention.

At TC Sessions: Mobility 2021 earlier this month, three auto executives spoke to the issues. Max Bajracharya of Toyota Research Institute, Mario Santillo of Ford, and Ernestine Fu of Hyundai described how their companies are now viewing the technology. It’s not about the auto industry, as much it its for these companies to make names for themselves — and clientele — in the robotics sector.

“I think all automakers are recognizing that there won’t be the automotive business in the future as it is today,” Bajracharya said. “ A lot of automakers, Toyota included, are looking for what’s next. Automakers are very well positioned to leverage what they already know about robotics and manufacturing to take on the robotics market.”

Yet on the factory job front, there still are expectations for machines replacing humans. A 2019 report from Oxford Economics estimates that about 8.5 percent of the global manufacturing workforce stands to be replaced by robots, with about 14 million manufacturing jobs lost in China alone out of the 20 million projected to be displaced by 2030. Over the next decade, the US may lose more than 1.5 million jobs to automation. The number of robots currently in the global workforce, 2.25 million, has multiplied threefold over the past 20 years, doubling since 2010. Of course, these statistics go far beyond automakers with manufacturing including computers, consumer electronics, clothing, parts and components, packaged food, and other segments.

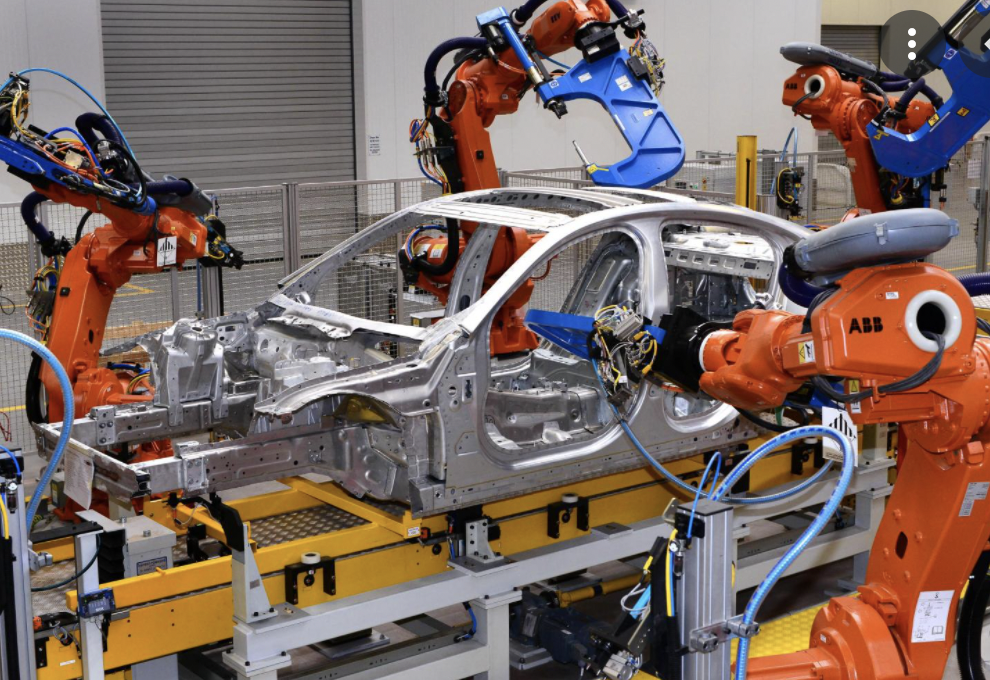

Four companies dominate the general industrial robotics market: Fanuc, Yaskawa, Kuka, and ABB. Automakers sometimes work with more than one of them, and other partners in automation.

There’s a correlation being made by automakers between robotics and EVs — through building and converting more factories into electric vehicle production and robotics playing an integral role. The connection seems to be more about electric autonomous vehicles and mobility. Robotic manufacturing might be included in the campaign they’re describing, at least for a few automakers.

Here’s a look at where all that’s going, starting with the big question: Will robotics take a leap forward, transforming vehicle manufacturing plants and upending the workforce?

BMW: The German automaker is betting on selling autonomous mobile robotics (AMRS) to the logistics sector. That will be through its Industry-Driven Engineering for Autonomous Logistics unit, which abbreviates to IDEAL and has the formal name of IDEALworks (IW). BMW Group started this unit in late 2020. The company has been partnering with Nvidia to develop mobile robots for internal use in their factories, primarily around automated material handling at the last mile, for a number of years. IW builds on this internal development and expands the scope to include autonomous robots in the logistics sector, and that could expand to couriers, 3PLs (third-party logistics), retailer stores, and online retailers.

The robot deployed is referred to as the small transport robot (STR) and is equipped with a Lips 3D camera and Sick sensors for safety. All robots rely on the Nvidia AGX hardware and makes significant use of NVIDIA’s SDK. BMW hopes to relieve employees from mundane and repetitive tasks so they can do better in their core competencies.

A year ago, the company confirmed it will cut about 6,000 jobs in Germany in an effort to cut costs as the automotive sector continues to struggle to recover from the Covid-19 outbreak. The German automaker and its works council agreed the workforce reduction will be achieved via a mixture of redundancies, early retirements, and not renewing temporary contracts, along with not filling new vacancies. It’s the first time since the financial crisis of 2008 that the company has had to cut staff. The company also tied the cuts to expanding focus on electric mobility and autonomous driving while boosting corporate efficiency.

BYD: On March 2, Beijing Horizon Robotics Technology R&D Co., Ltd. (Horizon Robotics), an AI chip supplier, held a strategic cooperation signing ceremony with BYD Co., Ltd., at BYD’s Shenzhen headquarters.

Horizon Robotics, a five-year-old company specializing in AI chips for robots and autonomous vehicles, sees huge potential in automotive partnerships. Horizon’s OEM and Tier 1 auto partners, according to the firm, include Audi, Bosch, Continental, SAIC Motor and BYD. Based on its own deep chip and intelligent technology accumulation, BYD says it will be cooperating with Horizon’s leading artificial intelligence chips and algorithms. It gives BYD a leverage point for adding AI, robotics, and automated vehicles, into its catalogue tied to electric vehicles and advanced batteries.

FCA: Fiat Chrysler Automobile’s robot unit Comau was spun off before the merger with PSA, for the benefit of all shareholders of the combined company. The Jan 19, 2021, $52 billion merger between FCA and PSA Group created Stellantis, now the fourth-largest automaker in the world. Comau is an Italian industrial automation company specializing in processes and automated systems that improve corporate manufacturing production through four core offerings: Controls; Teach Pendant with its ergonomic human robot interface; Auxiliary Equipment enabling equipment for increased functionality; and Software, offering digital tools to enhance processes.

Comau considers itself to be a leading company in the industrial automation field on the global playing field. The full portfolio includes: joining, assembly and machining solutions for traditional and electric vehicles, robotized manufacturing systems, a complete family of robots (including collaborative and wearable robotics) with extensive range and payload configurations, autonomous logistics, and asset optimization services with real-time monitoring and control capabilities. Tesla just because one of its clients this year.

Ford: In April, the company announced that at its transmission plant Livonia, Mich., where robots help assemble torque converters now includes a system that uses AI to learn from previous attempts how to make the production process more efficient. Inside a large safety cage, robot arms wheel around grasping circular pieces of metal, each about the diameter of a dinner plate, from a conveyor and slot them together.

Ford uses technology from a startup called Symbio Robotics that looks at the past few hundred attempts to determine which approaches and motions appeared to work best. A computer sitting just outside the cage shows Symbio’s technology sensing and controlling the arms. The enhanced automation allows this part of the assembly line to run 15 percent faster, a significant improvement in automotive manufacturing where thin profit margins depend heavily on manufacturing efficiencies, Ford said.

General Motors: General Motors announced late last year that Factory ZERO, Detroit-Hamtramck Assembly Center, the company’s all-electric vehicle assembly plant, is the first automotive plant in the US to install dedicated 5G fixed mobile network technology. Verizon’s 5G Ultra Wideband service is operating now at Factory ZERO, with its exponential increases in both bandwidth and speed supporting the ongoing transformation of the plant as it prepares to begin producing EVs in 2021.

It offers considerably faster download speeds and greater bandwidth than 4G networks. Factory ZERO is being completely retooled with a $2.2 billion investment, the largest ever for a GM manufacturing facility. Once fully operational, the plant will create more than 2,200 good-paying U.S. manufacturing jobs, the company said.

General Motors embraced smart manufacturing in 2018 through its Zero Down Time robot program in partnership with Japan’s Fanuc. Dan Grieshaber, GM’s director of global manufacturing integration, recently told Automotive News that the program includes 13,000 robots across GM’s 54 global manufacturing plants. The robots upload their data to Fanuc where the results are measured against GM’s performance expectations.

GM is using the system to troubleshoot maintenance issues and other quirks before they become serious. Another goal: helping prevent fatigue for workers that use repetitive motion. The sensors, actuators and tendons — comparable to the nerves, muscles and tendons in a human hand — increase dexterity for the worker. GM also uses collaborative robots or “cobots” that can operate around the human workforce without a safety cage.

Hyundai: In December, Hyundai Motor Group and SoftBank Group Corp. agreed on a transaction that placed Hyundai at an 80 percent controlling interest in Boston Dynamics in a deal that values the mobile robot firm at $1.1 billion. The deal came as Hyundai Motor Group envisions the transformation of human life by combining world-leading robotics technologies with its mobility expertise.

The two owners hope it will establish a leading presence in the field of robotics, and it will mark another major step for Hyundai toward its strategic transformation into a Smart Mobility Solution Provider. The Korean company said that it has invested substantially in development of future technologies, including autonomous driving technology, connectivity, eco-friendly vehicles, smart factories, advanced materials, artificial intelligence (AI), and robots.

Boston Dynamics produces mobile robots with advanced mobility, dexterity and intelligence, enabling automation in difficult, dangerous, or unstructured environments. The company launched sales of its first commercial robot, Spot, in June of 2020 and has since sold hundreds of robots in a variety of industries, such as power utilities, construction, manufacturing, oil and gas, and mining.

Nissan: As Nissan prepares to build a new generation of electrified, intelligent and connected cars, the company is making a series of investments to upgrade its production technologies and facilities, but the company is emphasizing the benefits that will come to employees more than cutting costs. Nissan’s mission is improving efficiency in terms of preventing mistakes, maintaining quality, ensuring that workers are freed from monotonous tasks, and reducing strain and fatigue from work.

One way to make improvements will be choosing when to automate. Certain assembly line processes are best suited for robots, particularly if they’re simple and repetitive yet relatively strenuous for humans. Another area of focus will be on industrial robots that work on things like welding and assembly are ordinarily kept in cages for safety reasons, due to their size, strength and speed of movement. Cobots (collaborative robots) seem to the answer here, for manufacturing processes where people and machines need to work closely together. Cobots offer robotic arms with limited strength and speed of movement. In addition to being extremely nimble, they can be easily reprogrammed to learn new tasks, Nissan said.

Tesla: Tesla and Stellantis-owned Comau are setting up a new series of automation equipment for manufacturing at Tesla’s Fremont Factory in Northern California. According to permits submitted by Tesla to the City of Fremont, Tesla will begin to anchor and install Comau’s products that entail highly automated and effective manufacturing techniques that are designed for electric vehicles.

Before Tesla started building its Model 3 compact sedan in 2017, CEO Elon Musk laid out a vision for its Fremont, Calif., assembly plant to become the factory of the future. But Musk had to learn similar lessons that what General Motors tried in the 1980s. GM saw its efforts backfire, as robots sprayed paint on each other and welding machines damaged vehicle bodies. Tesla’s efforts met a similar fate, as Model 3 production got off to a much slower start than the company had predicted. The delays were severe, and Musk later admitted he was wrong for trying to lean so heavily on automation. But the challenges persist, according to current and former Tesla employees. Mechanical problems are continuing at the Fremont plant, but this time are not cutting off production targets.

Toyota: Toyota has been developing industrial robots since the 1970s and has been bringing them into their manufacturing systems to improve quality and reduce costs. Robots are primarily used in their welding, painting, and assembly processes. In recent years, everything has been shifted over to Toyota Research Institute (TRI). Most recently, TRI has been refining its technology and service to be applied to the home. As societies age, there will be huge demand for increased caregiving, systems that enable us to live independently longer, and assistance for an increasingly aging workforce, the company said. Robots and automation can play a key role in freeing up people to spend more time with family, assisting people with tasks they enjoy, or helping them perform work for their jobs.

It will be drastically different than the machines Toyota has set up to make its factories more efficient. Here’s where machine learning and artificial intelligence (AI) methodology come to play. To address the diversity a robot faces in a home environment, TRI teaches the robot to perform arbitrary tasks with a variety of objects, rather than program the robot to perform specific predefined tasks with specific objects. In this way, the robot learns to link what it sees with the actions it is taught. When the robot sees a specific object or scenario again, even if the scene has changed slightly, it knows what actions it can take with respect to what it sees.

Volkswagen: Speaking of the aging global population, Volkswagen plans to use robots to cope with a shortage of new workers caused by retiring baby boomers. According to the company, the move to a more automated production line would ensure car manufacturing remains competitive in high-cost Germany. Similarly to other manufacturing outlets, VW predicts many of its workers will retire between now and 2030. Plus, a lack of skilled employees joining the business is forcing the company to look for alternative solutions.

The German automaker is also moving forward on automation at its electric vehicle plants. VW Passenger Cars and VW Commercial Vehicles divisions have ordered more than 2,200 new robots for the planned production of EVs at the German plants and the US plant in Chattanooga, Tenn. The company ordered more than 1,400 robots from the Japanese manufacturer Fanuc for their production facilities in Chattanooga, and from Emden in Germany. Volkswagen Commercial Vehicles is purchasing 800 or more robots from the Swiss manufacturer ABB for the carmaker’s Hanover, Germany, plant. The robots will be primarily used in body construction and battery assembly.

Volkswagen had been doing a lot of business with Kuka, bringing in thousands of robots to its plants all over the world. There’s been speculation that since Kuka was taken over by the Chinese technology group Midea in spring 2016, Volkswagen has been trying to become more independent of the robot specialist based in Germany. But the company has rekindled its relationship, including giving part of the production duties over to Kuka for its ID Buzz electric vehicle.

And in other news……….

Supercharger network opening up: Tesla will be breaking one of its golden rules: don’t let anybody beyond Tesla owners use its charging network. The company has told Norwegian officials that it plans to open the Supercharger network to other automakers by September 2022. A decade after deploying the first Supercharger, Tesla now has over 25,000 Superchargers at over 2,700 stations around the world. But opening it up has been in the works. Last year, CEO Elon Musk said that Superchargers are now being used “low-key” by other automakers.

A German official recently announced that they have been in talks with Tesla to open up the network to other automakers. In Norway, Tesla wants incentives from the government to open up its Supercharger network. Government officials confirmed that

Tesla told them that it plans to open the Supercharger network to other automakers by Sept. 2022, and they will approve the incentives as long as Tesla goest through with the initiative.

It would be viable for Tesla to open its chargers throughout Europe, where its Supercharger network uses the CCS connector, which is standard in the region. However in North America, Tesla would have to offer an adapter since it uses a proprietary plug on its vehicles and charging stations in that market.

Ford and Argo report on AV improvements: Ford just released more details on its self-driving vehicle development, the first time since its 2018 safety report to the US Dept. of Transportation. In addition to working with Argo AI to advance the development of a robust Automated Driving System to guide Ford vehicles on roads, the automaker continued to research and develop an improved customer experience, fleet management capabilities, behind-the-scenes transportation-as-a-service software, and more.

In addition to Miami, Ford plans to launch its self-driving service in Washington, D.C., and Austin, Texas. In all three of these cities, Ford established robust testing and business operations, including terminals and command centers to manage these fleet of vehicles as they transport people or deliver goods. Ford’s newest self-driving test vehicles are built on the Escape Hybrid platform, taking advantage of increased electrification capabilities and featuring the latest in sensing and computing technology. The Escape will be utilized to initially launch the service with.

Alongside testing in Miami, Austin and Washington, D.C., Argo AI continues to test the Automated Driving System in Detroit, Pittsburgh, and Palo Alto, Calif. These projects have helped the company integrate self-driving test vehicles directly into its business pilots, offering real-world insights into what is required to run an efficient self-driving business.

Ford hopes to be a part of city transportation systems and provide a service that helps make people’s lives better. An example is the collaboration in Miami that created a Ford-designed smart infrastructure. Ford worked closely at the city, county, and state level to begin researching complex intersections. The data will help Ford and transportation officials better understand how autonomous vehicles can better navigate through busy or tricky intersections.

Argo continues to make significant advances toward enabling commercialization — including the recently announced Argo Lidar sensor with sensing range capability of 400 meters. This new technology enables Ford and Argo to test vehicles on highways and help connect vehicles to warehouses and suburban areas, expanding potential service areas for ride-hailing and goods deliveries.