The Tesla Model Y is the clear global and national winner so far this year — 409,378 units sold globally through the end of August followed by Wuling Hong Guang Mini EVs at 278,838. The Telsa Model 3 was third at 268,157 vehicles sold, according to InsideEVs. BYD took six of the remaining Top 10 global units during the first eight months of this year.

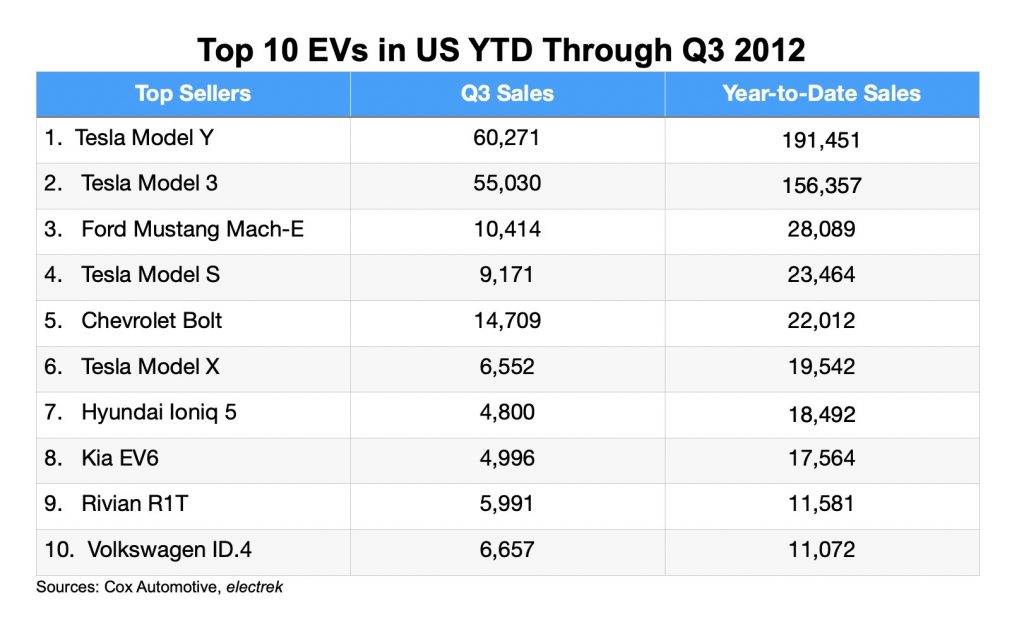

Tesla still dominates the US market, but car buyers are starting to open up to alternatives more so this year than in the past. Once you get away from the obvious top two selling Teslas, the Ford Mustang Mach-E, Tesla Model S, Chevrolet Bolt, Tesla Model X, Hyundai IONIQ 5, and Kia EV6 came in fairly close together in sales during the first three quarters of this year. The Mustang Mach-E, Ioniq 5, and EV6, are newcomers to the list and are doing particularly well.

And in other news……

A locked-down China: Public protests aside, China continues to be a strange place to be. Driven by Chinese President Xi Jinping’s lockdown to fight Covid, automakers have had a hard time running their businesses. BMW expects to see more COVID-19-related lockdowns in China into next year, despite strong demand there for the automaker’s full-electric models and expectations of stable global sales. Honda suspended its operations in Wuhan, the city where the pandemic began in 2020, because of limitations being placed around movement enforced in the area. How long it will remain closed is yet to be seen. Jeep declared bankruptcy for its part in the GAC-FCA joint venture just months after Jeep’s parent Stellantis had increased its share in the company. Tesla and Mercedes have been taking action to stabilize their presence in China’s large electric vehicle market. Tesla is changing it marketing starting and offering insurance subsidies as part of cost cuts. Mercedes slashed the price for its flagship EQS electric sedan by as much as $33,000 to restore is share in the world’s largest EV market. Volkswagen halted production at a joint venture plant that it has with China FAW Group on Monday of this week. The German automaker attributes the shutdown to a shortage of components.

Exhibitor information is available for the 36th Electric Vehicle Symposium and Exhibition (EVS36), taking place June 11-14, 2023 in Sacramento, Calif. Registration for attendees opened up on Oct. 3. Organized and hosted by EDTA, it’s considered to be the premier global showcase for industry innovation and is the longest-running international conference devoted to electric transportation and technologies. Featuring compelling presentations from industry and thought leaders, a cutting-edge exposition with exhibitors from around the globe and multiple networking events, EVS36 will provide a wide array of opportunities to showcase leadership, learn from the experts and educate the public and the media about electric transportation.

California’s Advanced Clean Fleets Rule: Beyond the zero emission vehicle mandate, California is rolling out its Advanced Clean Fleets (ACF) Rule that was put together by the California Air Resources Board (CARB) and later backed by Gov. Gavin Newson. It applies to drayage fleets and those operated by state, local, and federal agencies, as well as “high priority fleets.” CARB says that “high priority fleets” are companies with $50 million or more in gross annual revenue that either own, operate, or control at least one vehicle with a gross vehicle weight rating (GVWR) greater than 8,500 pounds, or entities that own, operate, or control a total of 50 or more vehicles with a GVWR greater than 8,500 pounds. As for timeline, CARB states that 100% zero-emission drayage trucks, last mile delivery, and government fleets are in place by 2035; 100% zero-emission refuse trucks and local buses by 2040; and 100% zero-emission capable utility fleets by 2040. There are also regulatory components to the proposed rule that would affect manufacturers, local and state agencies, drayage fleets, and high priority and federal fleets that break out the mandates and timing.

Investors not feeling good about Musk and Twitter: According to a survey conducted by Morgan Stanley, a bulk of investors are distressed by the drag on Tesla shares driven by Elon Musk’s Twitter purchase. About 75% of respondents to the bank’s survey indicated that the Twitter purchase has been a major contributor to the steep slide for Tesla share prices as of late, with 65% also indicating the acquisition will have a “negative or slightly negative impact on Tesla’s business going forward.” Only 5% said the acquisition is likely to be positive for the automaker’s business — a strange statistic to see from a financial community used to praising Musk. The social media giant continues to go through upheaval under Musk with layoffs and other bad news moving along. They have been happy to find out the company has delivered its first electric semi truck in California. CARB had awarded the grant to an air district in California’s Central Valley that partnered with PepsiCo’s Frito-Lay to transform its manufacturing site in Modesto, Calif. The company wanted to replace all of its diesel-powered freight equipment with zero-emission trucks and install solar panels and energy-storage systems.

Coal ain’t going away soon: Coal is the world’s single-largest source of carbon dioxide emissions from energy, and massive efforts are needed to quickly reduce these emissions to avoid severe climate change impacts, according to International Energy Agency (IEA). In a new special report – Coal in Net Zero Transitions – the agency lays out what is needed to reduce global coal emissions rapidly enough to meet international climate goals while supporting energy security and economic growth. The analysis in the report, which was launched on Energy Day during the COP27 Climate Change Conference in Egypt, shows that over 95% of global coal consumption is occurring in countries that have pledged to achieve net zero emissions. To reverse this reality, super-charging the renewable energy replacing coal, and extensive job training and development spending is needed.

Texas seeing a lot of methane emissions: A special report from PBS that first aired Nov. 23, explored how extensive Texas’ destructive methane emissions is, with much of it coming from the regional Permean basin that comes from hydraulic fracturing into the earth (called fracking) for natural gas. Sharon Wilson of environmental group Earthworks is shown doing a “climate bomb” with a sophisticated $100,000 camera that tracks and records pollution. About 1,100 super emitters have been found in Texas by this organization and other testers. Natasha Miles, a Penn State University participating in a study measuring emissions, disputes industry reporting about fumes being released. Her research team has found five times more emissions than what’s being reported by companies doing the fracking. Investigations being done by Texas Commision on Environmental Quality has been far from impressive and authentic.