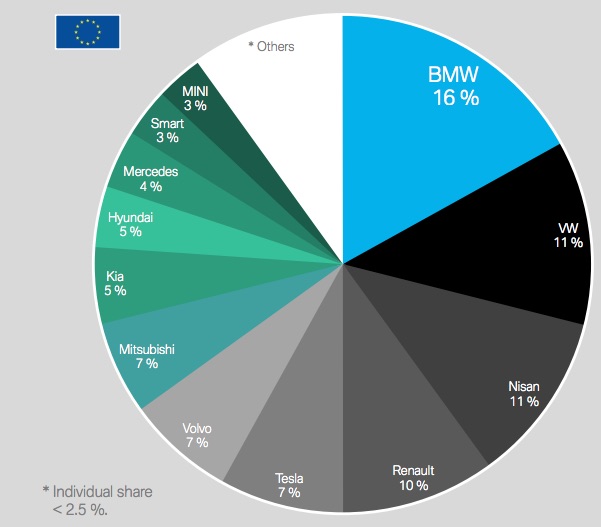

Competitors beating Tesla in Europe: While Tesla dominates electric vehicle market share in the U.S., Europe is benefiting local automakers even more. BMW just issued a  report conducted by IHS Markit based on new vehicle registrations from Feb. 2018 to Feb. 2019. BMW has 16 percent of plug-in vehicle market share in Europe, while Tesla ties for fifth place with Volvo. Volkswagen, Nissan, and Renault came in 2nd through fourth place. In Germany, BMW has 20 percent share with Tesla coming in at 3 percent. In Norway, the largest EV market in Europe, BMW has nearly 77 percent of that market while Tesla saw its sales drop there in the fourth quarter. Lack of retail stores in key European metro market areas is probably a factor. Tesla is tied with China’s BYD for first place globally, with Beijing Auto coming in second and BMW third. China is expected to play a big role in the future of EV sales. Tesla is getting ready to open its Shanghai production plant in May; while BMW was granted permission last year by the Chinese government to increase its stake in Brilliance China, the first company to take more than 50 percent in one of the joint venture vehicle manufacturers with factories in China. BMW hopes to lower its costs in that market, with EVs expected to be part of its growing presence.

report conducted by IHS Markit based on new vehicle registrations from Feb. 2018 to Feb. 2019. BMW has 16 percent of plug-in vehicle market share in Europe, while Tesla ties for fifth place with Volvo. Volkswagen, Nissan, and Renault came in 2nd through fourth place. In Germany, BMW has 20 percent share with Tesla coming in at 3 percent. In Norway, the largest EV market in Europe, BMW has nearly 77 percent of that market while Tesla saw its sales drop there in the fourth quarter. Lack of retail stores in key European metro market areas is probably a factor. Tesla is tied with China’s BYD for first place globally, with Beijing Auto coming in second and BMW third. China is expected to play a big role in the future of EV sales. Tesla is getting ready to open its Shanghai production plant in May; while BMW was granted permission last year by the Chinese government to increase its stake in Brilliance China, the first company to take more than 50 percent in one of the joint venture vehicle manufacturers with factories in China. BMW hopes to lower its costs in that market, with EVs expected to be part of its growing presence.

Ford building more EVs and AVs in USA: Ford has recommitted to building more electric vehicles and autonomous vehicle technology at its North American plant, with less emphasis on AVs. The $900 million Ford had planned to spend on AV production in its Flat Rock Assembly plant in Michigan through 2023 will instead be largely dedicated to EVs and the next-generation Mustang, the company said. The Flat Rock plant will become the production home to vehicles from the company’s “next-generation battery electric flexible architecture.” These vehicles will follow the all-electric performance SUV coming in 2020 from Ford’s Cuautitlan, Mexico, plant. Autonomous vehicles will be coming from a new AV manufacturing center in southeast Michigan. The company said that production of Ford’s first autonomous vehicles will begin in 2021 for deployment in commercial services to move people and goods.

Trump attack misses the point: In the aftermath of a bitter Twitter feud with General Motors and the United Auto Workers in previous days, President Trump visited Ohio to continue attacks. After viewing the Lima, Ohio-based Joint Systems Manufacturing Center, which makes the 1M Abrams tank, on Wednesday, Trump attacked deceased Sen. John McCain and blamed Democratic union leaders for GM’s decision to close a plant in Lordstown, Ohio, eliminating about 1,700 jobs. All of this comes after announcements by GM and Ford late last year to initiate layoffs and close more plants to offset losses in the slowing economy and the steep tariffs implemented by the Trump administration. Tesla stirred up its own controversy last week after announcing it would close its U.S. retail stores and go to online sales to cut costs — which CEO Elon Musk later cut down to an expected 10 percent to 30 percent store closures. Tesla is joining several major global companies feeling pressure to close retail stores as shareholders put more pressure on management to increase performance and profits. Stores may not be worth the cost as companies such as Amazon lead the revolution toward online shopping and fast delivery services, analysts say. Overall, GM, Ford, Tesla, and competitors are facing a wave of changes in the imminent future impacting profits and market share. Job losses will continue as industries consolidate, robotics take over plants, and consumers want less retail stores and more digital transactions. The issues are much deeper than merely job losses at plant closures in Ohio and Michigan.

Model Y reveal: Tesla CEO Elon Musk revealed the company’s Model Y a week ago, a compact SUV that had been mentioned long before. It shares the same architectural platform with the Model 3 compact electric car. It’s more conservative than Tesla’s other SUV, the Model X, with its falcon-wing doors. It’s putting safety and cost savings before flash, as Tesla continues to reach out more to middle income consumers with its Models 3 and Y. It offers the perks of a hatchback such as the Toyota Prius with the advantages of driving a smaller vehicle through crowded cities instead of a large SUV. The Model Y’s Standard Range model will roll out in the spring of 2021 with a $40,200 price tag and a 230-mile range.

Plug-in sales for February: EDTA’s Electric Drive Sales Dashboard on U.S. sales in February reported 17,239 plug-in vehicles sold, made up of 6,792 plug-in hybrids and 10,447 battery EVs. The 34,279 plug-in vehicles sold so far in 2019 represents a 19 percent increase over the total sold thru the same period last year. The association will be including fuel cell electric vehicle sales data in future reports.

Prediction on electric trucks: GNA’s Erik Neandross shared his thoughts on the boom coming this year with electric trucks coming to market at major trade shows and through compliance with government policy. Much will be learned in the next one-to-three years as a wave of electric work trucks come to market. Fleet managers and operators will be taking a close look at operating costs as more EVs go into daily fleet operations.