These topics continue to be big in the auto industry and transportation sector, a trend which started up around 2007. Here are what might be considered the top 10 news developments for this year……

These topics continue to be big in the auto industry and transportation sector, a trend which started up around 2007. Here are what might be considered the top 10 news developments for this year……

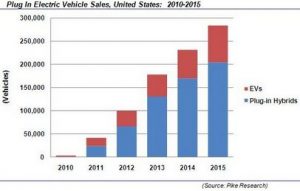

New model launches and revamps – The Chevrolet Bolt, Tesla Model X, and revamped Toyota Prius, Chevrolet Volt, and Nissan Leaf were announced or released this year. The introduction of the Bolt led to the conclusion that battery electric vehicles with 200 miles per charge would be enough to find a wider level of acceptance from car shoppers (along with a more affordable price). The Model X was delayed and gained a lot of attention in blogs and social media on when it will actually be delivered to owners. The Prius, Volt, and Leaf are seeing their biggest changes adopted since first being launched, and are expected to see sales gains. Of course, increasing gasoline prices would help with consumer demand for green cars.

Volkswagen scandal – The U.S. Environmental Protection Agency in September found that several cars sold by Volkswagen through its VW and Audi brands were given a “defeat device,” which is software in diesel engines that could detect when they were being tested, changing the performance accordingly to improve results. The EPA’s findings cover 482,000 cars in the US only, and VW admitted that about 11 million cars worldwide, including eight million in Europe, are fitted with the defeat device. VW has denied another claim by the EPA of modifying software on the three-liter diesel engines fitted to some Porsche, Audi, and VW models. VW has been firing employees and bringing in outside inspectors; and its numbers have changed on how many vehicles sold in Europe are affected by “irregularities” in tests to measure carbon dioxide emissions – from about 800,000 in November to only about 36,000 in December following investigations. VW will be losing billions of dollars as government investigations and fines in Europe, North America, and Asia continue, class-action lawsuits pile up, and car shoppers choose other brands.

Renewable fuels – Renewable fuels saw significant gains this year with availability of commercial scale renewable natural gas, renewable diesel, and cellulosic ethanol. Fleets in California are adopting these fuels faster than in other states, but the interest level is high nationwide. California’s low carbon fuel standard and funding its producing in carbon credits is helping the new fuel move along, too. One of the best parts is that fleets can use existing diesel, flex fuel, and CNG vehicles with these renewable fuels to significantly reduce emissions.

Tesla Energy – Tesla Energy is bringing Tesla batteries to homes, business, and utilities to store energy to better manage power demand, provide backup power, and increase grid resilience – with much of it coming from solar power. Called the Tesla Powerwall, it includes Tesla’s lithium-ion battery pack, liquid thermal control system, and software that receives dispatch commands from a solar inverter. Soon after its launch in May, Tesla gained $800 million worth of reservations in the Powerwall.

Chinese companies enter America – Along with the Chinese government’s mandate to bring more electric vehicle to pollution-packed Chinese cities, the U.S. has been seeing more presence from Chinese investors in U.S.-based facilities producing electric cars. Fisker Automotive, owned by Chinese auto parts giant Wanxiang, signed an 11-year lease deal estimated to be worth about $30 million. Fisker will be opening a production plant in Moreno Valley, Calif., about 60 miles from its corporate office in Costa Mesa. Later in the year, the company was renamed Karma Automotive. Chinese startup electric carmaker Faraday Future will spend $1 billion on a U.S. factory and operates out of a former Nissan research facility in Gardena, Calif., next to Los Angeles. NextEV is a well-funded electric-vehicle startup backed by firms in China. The startup has an 85,000-square-foot U.S. headquarters and R&D center based in San Jose, Calif.

COP21 – The U.N. climate change agreement moved forward for the first time in several years. To help developing countries switch from fossil fuels to greener sources of energy and adapt to the effects of climate change, the developed world will provide $100 billion a year. The Obama administration was pleased with the agreement, including the section where all countries will be required to report on national inventories of emissions by source and also to report on their mitigation efforts. At the beginning of the Paris meetings, billionaire Bill Gates announced formation of the Breakthrough Energy Coalition, a group of 28 investors that will include Gates, Amazon CEO Jeff Bezos, Facebook CEO Mark Zuckerburg, and Virgin Group founder Richard Branson. The dollar amount hasn’t been announced, but investment funds will be available for biofuels, solar and wind power, efforts to capture carbon emissions from fossil fuels, and other clean energy projects. Another coalition that has met during COP21 is the ZEV Alliance, a group of local and national governments that plans drastic reductions in vehicle emissions over the next 35 years.

Uber and other shared economy suppliers – The “shared economy” has gained a lot of attention this year with companies like Airbnb making personal homes available to travelers who want to spend a lot less on lodging and want to avoid the corporate hotel environment. Uber and Lyft have taken off in ridership, where car owners share their personal vehicles for a fare to take passengers to airports, work, social life, etc., for half the cost of a taxi ride. Zipcar, Car2go and other carsharing suppliers are seeing their user numbers grow in the past year as more consumers lose interested in car ownership and want to have solid transportation alternatives in place.

Urban mobility – “I believe we’ll see more change in the automotive industry in the next five to 10 years than in the past 50. Driving this historic transformation are shifting views of vehicle ownership, growing urbanization and the very digital and sharing economies that have disrupted so many other industries,” wrote General Motors CEO Mary Barra in a LinkedIn guest editorial. Shared mobility, autonomous vehicles, and alternative propulsion were analyzed in her column. These are the reasons Green Auto Market has added a new section on advanced transportation and urban mobility – very big changes are in the works.

Autonomous vehicles – This topic continued to be hot in 2015. Along with the California DMV deciding to require a human passenger in the driver’s seat for emergency takeovers, Google and Ford made big news deciding to forge an alliance for joint development of autonomous vehicles. That could help jump-start testing an autonomous version of the Ford Fusion Hybrid sedan on public roads near its high-tech center in Silicon Valley in the near future. Another interesting move has been Austin, Texas, courting Google to set up self-driving car testing in that city.

FAST Act – House and Senate negotiators passed the Fixing America’s Surface Transportation (FAST) Act, a five-year, $305 billion package, in early December in a 1,300 page transportation bill. Signed into law by the president, advocates are pleased to see support for the Congestion Mitigation and Air Quality Improvement Program; incentives for natural gas vehicles and fueling infrastructure; and support for intelligent transportation systems. Electric vehicle advocates are also pleased with FAST Act. One of the items in the final bill is a mandate for the Department of Transportation to designate corridors for electric-car charging; it also requires more hydrogen, natural gas, and propane fueling on the nation’s highways.

Accord comes with three now powertrain options – two direct-injected and turbocharged 4-cylinder engines and the third generation of Honda’s two-motor hybrid powertrain. The Honda Clarity comes in all-electric, plug-in hybrid, or hydrogen fuel cell options. The Hyundai Ioniq comes in three versions – hybrid, battery electric, and plug-in hybrid. The all-new Nissan Leaf comes with a redesigned look, longer driving range, and Nissan Intelligent Mobility technologies, Toyota’s eighth generation Camry is available with three new powertrains – a 2.5-liter 4-cylinder, 3.5-liter V-6, and a Hybrid powered by the automaker’s next-generation Toyota Hybrid System. The winner will be named at 8:00 am PST on Nov. 30 inside the Technology Pavilion.

Accord comes with three now powertrain options – two direct-injected and turbocharged 4-cylinder engines and the third generation of Honda’s two-motor hybrid powertrain. The Honda Clarity comes in all-electric, plug-in hybrid, or hydrogen fuel cell options. The Hyundai Ioniq comes in three versions – hybrid, battery electric, and plug-in hybrid. The all-new Nissan Leaf comes with a redesigned look, longer driving range, and Nissan Intelligent Mobility technologies, Toyota’s eighth generation Camry is available with three new powertrains – a 2.5-liter 4-cylinder, 3.5-liter V-6, and a Hybrid powered by the automaker’s next-generation Toyota Hybrid System. The winner will be named at 8:00 am PST on Nov. 30 inside the Technology Pavilion. major Indian automaker has sold. The country is making efforts to reduce emissions and curb fuel imports. Prime Minister Narendra Modi sees the EV acquisition as a way to support the country’s pledge to ban the sale of internal combustion engine light-vehicles by 2030. Mahindra and Mahindra has so far been India’s only domestic carmaker that currently makes EVs. India is far behind China in EV sales, with China selling about 336,000 units last year versus about 450 in India, according to the International Energy Agency.

major Indian automaker has sold. The country is making efforts to reduce emissions and curb fuel imports. Prime Minister Narendra Modi sees the EV acquisition as a way to support the country’s pledge to ban the sale of internal combustion engine light-vehicles by 2030. Mahindra and Mahindra has so far been India’s only domestic carmaker that currently makes EVs. India is far behind China in EV sales, with China selling about 336,000 units last year versus about 450 in India, according to the International Energy Agency.