As the stunning election results settle in, speculation on the implications is pervasive through news and social media channels.

As the stunning election results settle in, speculation on the implications is pervasive through news and social media channels.

I do have two questions. What will President-elect Donald Trump’s administration be doing, and opposing, in the realm of cleantech and transportation? What can clean transportation stakeholders do to respond?

To start off, what happened with the election that set up such stunning results? Media analysts and pundits were using early polling findings and experience from past elections to assume they knew the outcome, until election evening. Pollsters assumed they knew how voters were going to vote, and they did seem to be accurate about how regular voters were going cast their ballots. It turns out that quite a few disenfranchised voters who hadn’t punched a ballot in years showed up and cast their vote for Trump. A lot of Millennial generation voters who had loved Bernie Sanders but settled for Hillary Clinton didn’t bother to show up and vote or to mail an absentee ballot. Clinton may have won the popular vote but lost in key electoral vote states, the fourth time that’s happened in U.S. history; but ballots are still being counted to determine the popular vote total.

We may have received a signal of where the new administration will be standing on some of the relevant issues. Right after Election Day, a statement was released on a review of the fuel economy and emissions standards by the new administration.

“The Trump Administration will complete a comprehensive review of all federal regulations. This includes a review of the fuel economy and emissions standards to make sure they are not harming consumers or American workers,” said John Mashburn, a senior policy adviser for Trump, as reported by Automotive News. “It is important to remember that this particular program was first put in place as a way to reduce our nation’s dependence on foreign oil, not for purposes of global warming regulation. Mr. Trump will be focused on bringing jobs, including auto manufacturing, back to the U.S., and making sure that government policies are in the national interest.”

On Thursday, the Alliance of Automobile Manufacturers sent a letter to President-elect Trump’s White House transition team asking to ease regulatory pressure from the Obama administration’s fuel economy and emissions rules calling for 54.5 mpg by 2025. The rules, which become increasingly stringent in the 2017 model year, are considered to be a “substantial challenge” for the industry, according to the letter. While alliance members (including General Motors, Ford, BMW, Mercedes, VW, Mazda, Volvo, Fiat, and Toyota) have supported the program, the industry is concerned about the timing and costs of the rules, which will require billions of dollars in investment.

Here are a few legislative, regulatory, and economic issues to follow:

- Grant funding: U.S. Department of Energy and U.S. Environmental Protection Agency funding is likely to be scaled back as the Obama administration leaves office. That means low-interest loans and grants for advanced vehicle technology projects by automakers, suppliers, universities, and research center partners will probably lose funding. Other parties likely to lose funding include electric vehicle charging infrastructure suppliers; alternative fuel vehicles being deployed in the federal fleet; grants for research and development of alternative fuels like biofuels and renewable natural gas and diesel; and clean transportation projects aimed at cargo transport. Fleets, OEMs, and suppliers will need to tap into other resources like state, regional, and city funding programs; and university R&D projects.

- EV incentives: The Trump administration is likely to lose interest in renewing and expanding federal tax incentives for purchasing electric vehicles, which go up to $7,500. General Motors and Nissan are close to reaching the cap on allowable EVs qualifying for the tax incentives, and other automakers will follow. These incentives will go away unless renewed. Trump has expressed opposition to the government picking “winners and losers” and tends to not show support for government action continuing these types of programs. Like grants, automakers will need to turn to other sources like states for funding and utilizing their own purchase incentive programs to attract green car buyers.

- Watch for gridlock in Washington: Trump and his campaign statements have been opposed to the Obama administration on clean energy policies. Trump has called climate change a hoax during the campaign, and promised to renegotiate the United Nation’s Paris climate accords. He’s opposed to the Obama administration’s Clean Power Plan, which is directing utilities to reduce carbon emissions. Some of Trump’s dramatic proposals may also see resistance from Republican committee chairs in Congress. To carry out his wish of abolishing the EPA would need broad support in the House and Senate. When it comes to the huge investment Trump promised to spend on roads and other infrastructure, he will likely face stiff opposition from fiscally conservative Republicans. Environmental groups have expressed deep concerns over where Trump’s policies will be heading. “We’re feeling angry and sad and contemplative,” said Michael Brune, executive director of the Sierra Club. “Trump is now, as president-elect, soon to be the only head of state on the planet that doesn’t believe in climate change, nor thinks we should do anything about it. That should strike fear in the hearts of every parent in this country.”

- Globalization: Trump took on Ford Motor Co. and its plans to move all its small-car assembly plants to Mexico as a pivotal issue during stump speeches from the very beginning of his campaign. Ford is not the only automaker in Mexico, with Trump also taking aim at General Motors for its plans to invest $5 billion more in Mexico. Other companies have been there for years like BMW, Chrysler, Fiat, Honda, and Volkswagen. It certainly goes way beyond Mexico with automakers also investing heavily in operations overseas in places like China, India, and Brazil. Trump has been able to stir up anger and frustration for workers at vehicle manufacturing and parts and components plants who’ve lost their jobs in the Great Lakes region, or who’ve feared it will happen to them next. Union members who usually vote Democrat leaned toward Trump. Fear of losing jobs to overseas markets has touched a nerve. The United Auto Workers, which had campaigned against Donald Trump this fall, is prepared to support his bid to overturn the North American Free Trade Agreement. Trump has also said he plans to reject or renegotiate other trade deals. Automaker executives will have to sort this out in dealing with the Trump administration and its decisions on tariffs, trade agreements, and statements affecting the public’s attitudes about the auto industry.

- China: The alliance between the U.S. and China has been a central part of the Obama administration’s foreign policy and clean energy initiatives. The Chinese national government and regional entities have given generous subsidies to foreign companies and investors to set up manufacturing and assembly plants in China. That strategy has contributed significantly to China’s economy, with companies like Apple and General Motors taking it very seriously. That international alliance has been tracked closely in the past year by Green Auto Market and other publications as sales of battery electric and plug-in hybrid vehicles have taken off in China, making Chinese company BYD the third largest seller of EVs in the world. Chinese backers such as Wanxiang Group have played a vital role in seeing companies like Karma Automotive and A123 Systems establish a foothold in the U.S. and, eventually, in China. As reported in media, developing and maintaining a strong and mutually beneficial relationship with China has been, to say the least, challenging for the Obama administration; relations between the two nations are much more tense now than they were in 2009. The Trump administration may not do well with that tension and could break ties that have been set in the past eight years – if U.S. interests in China and the Asia-Pacific region aren’t perceived as making forward gains. The climate change agreement with China is also likely to languish under the new presidency. If you review the Trump website’s policy section, you’ll find a few statements on free trade that indicate where things may be going with China: “Instruct the Treasury Secretary to label China a currency manipulator…… Instruct the U.S. Trade Representative to bring trade cases against China, both in this country and at the WTO (World Trade Organization). China’s unfair subsidy behavior is prohibited by the terms of its entrance to the WTO…….. Use every lawful presidential power to remedy trade disputes if China does not stop its illegal activities, including its theft of American trade secrets.”

- Tesla CEO Elon Musk’s viewpoint: “I think a bit strongly that (Trump) is probably not the right guy” for the presidency, and wouldn’t be the best candidate to represent the U.S. abroad, he told CNBC on the Friday before the election. Democratic presidential nominee Hillary Clinton’s economic and environmental policies “are the right ones,” Musk said. Other automakers have expressed concerns over policies likely to be adopted by the Trump administration, but have kept a neutral stance on the outcome of the election.

- CARB: California’s Air Resources Board has rescheduled a key hearing from Dec. 8-9 until sometime in February; that will be after Trump has taken office and there’s more clarity on where the nation’s clean-air rules overseeing vehicles are headed. The delay in the hearing is needed to give more time to gather reaction to recommendations the board staff is now preparing, a board spokesman said. The Alliance of Automobile Manufacturers also wants to see states follow CARB’s lead on the zero emission vehicle policy to avoid a patchwork of problems. Automakers would like to see the nine other states that have adopted the ZEV policy to follow California’s practice of supporting the mandate with tax incentives and other programs. That’s led to “dramatically” different ZEV credit purchase rates outside of California, the trade group said.

- Biofuels vs. oil: The EPA said on Thursday it plans to deny several petitions from oil groups to change the country’s biofuels program, an issue that has deeply divided the petroleum industry. The oil industry has spent millions lobbying against the Renewable Fuel Standard (RFS), which mandates biofuels being blended into gasoline and supports development of advanced alternative fuels such as biodiesel and cellulosic ethanol. A final decision will probably not be made until Trump is in the White House. The Trump administration is more likely to consider the refiners’ requests, said Timothy Cheung, vice president at ClearView Energy Partners in Washington. A policy statement from Trump’s campaign website may shed some light on the new administration’s support for oil and gas: “Unleash America’s $50 trillion in untapped shale, oil, and natural gas reserves, plus hundreds of years in clean coal reserves.”

- As for possible responses to the Trump administration potentially blocking support for electrified transportation, alternative fuels, and infrastructure – along with market dynamics moving forward no matter who had won the presidential election – here are a few to watch for:

- Adoption of electrified vehicles: A report by Michigan-based analyst Alan Baum forecasts that by 2018, the number of hybrid, plug-in hybrid and all-electric models sold in the U.S. will jump to 92 from 58 this year. Baum expects hybrid and EV sales to rise well above their current margin of about 3% of U.S. new vehicle sales in the next 10 years. Daimler and BMW both have predicted plug-in electrified vehicle sales will account for as much as 25 percent of their total deliveries in about 10 years. Volkswagen said in June that the company will launch more than 30 all-electric vehicles over the next 10 years with a goal of selling two to three million of these EVs in 2025. Tesla will be producing about 500,000 electric vehicles beginning in 2018 as the Model 3 comes to market in late 2017. General Motors plans to compete directly with the Model 3 with its Chevrolet Bolt electric car, which just started rolling off assembly lines.

- Fleets will continue to play an important role: Fleets are among the early adopters for new vehicle technologies and will continue to play that important role. If Trump makes the climate change argument harder to buy into, fleets are usually skilled at making the case for adoption of clean vehicles other ways, including emphasizing energy independence and return on investment. The clean vehicle may be higher in acquisition cost but will reach payback in a reasonable amount of time compared to the cost of gasoline and diesel; and the cost of maintaining internal combustion engine vehicles when compared to plug-in electrified vehicles. Clean Cities coalitions have been very helpful in assisting fleets, and their OEM and supplier partners, to make the business case for adopting clean vehicles.

- Trade disputes: Arguments between the U.S. and China over fair trade practices will likely mean less in the coming years. GM, Ford, Volkswagen, Hyundai, BMW, Daimler, Nissan, Honda, Toyota, Mazda, and other automakers already have joint-venture alliances with Chinese automakers. EVs are being added to their product lineups for sale in China. Chinese automaker BYD has a large stake owned by Warren Buffet and Berkshire Hathaway. Tesla is investing heavily in setting up stores and service centers in China, and is eying Shanghai for setting up a factory. A similar trend is carrying over to the U.S. market, where Wanxiang America has set up its headquarters in Chicago, BYD is manufacturing and selling electric buses, and other Chinese investors have stakes in U.S.-based electric vehicle makers and suppliers. Whether Trump or auto workers like it or not, globalization is a dominant economic force, right up there with new technologies being developed. Automakers are looking at opportunities all over the world, including Renault-Nissan planning on bringing more hybrid vehicles to Europe to replace diesel cars; and Mitsubishi bringing its Outlander PHEV over the U.S. market after seeing it become a top-selling plug-in electrified model in several European countries.

- Creative financing: Federal grants and low-interest loans are likely to fade away, but there are other sources to consider. California is well known for grant programs, including through the AQMD entities; Chicago and New York have been funding clean transportation programs, and other cities and states are renewing their incentive programs. Startup OEMs, suppliers, and charging and alternative fueling infrastructure companies have turned to other capital sources and will continue to do so. Watch for more activity coming from crowdfunding, angel investors, and private equity firms. Ride-hailing giant Uber has set the tone for private investors to come through, and that’s crossing over to competitors and startups in food and packaged goods delivery.

- Keep on keeping on: During Hillary Clinton’s concession speech Wednesday, she encouraged young professionals to stay committed to their goals no matter how an election may turn out. Sierra Club, Natural Resources Defense Council, and Ceres issued their own statements reaffirming their commitments to environmental objectives. NRDC published its own statement on the matter the day after the election: “Know this: NRDC will fight for our environment, for our climate, and for our shared clean energy future — harder than we ever have fought before.”

Hybrid and EV sales: Hybrid and plug-in sales

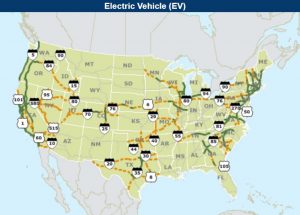

Hybrid and EV sales: Hybrid and plug-in sales  As you probably know by now, the Federal Highway Administration released a map last week showing 55 routes across the U.S. for charging plug-in vehicles and refueling alternative fuel vehicles, with 48 designated charging routes in the new corridor. The Alternative Fuel Corridors covers 35 states and nearly 85,000 miles, according the U.S. Department of Transportation’s FHWA. More miles will be added to the network to accommodate electric, hydrogen, propane autogas, and natural gas vehicles as more alternative fueling and charging stations are built.

As you probably know by now, the Federal Highway Administration released a map last week showing 55 routes across the U.S. for charging plug-in vehicles and refueling alternative fuel vehicles, with 48 designated charging routes in the new corridor. The Alternative Fuel Corridors covers 35 states and nearly 85,000 miles, according the U.S. Department of Transportation’s FHWA. More miles will be added to the network to accommodate electric, hydrogen, propane autogas, and natural gas vehicles as more alternative fueling and charging stations are built. ZEV credits: The California Air Resources Board may plan this week for the state’s emissions targets to remain largely unchanged through 2025 and then jump after that year, according to three people familiar with the proceedings. This will disappoint Tesla CEO Elon Musk and environmental groups that have called for expansion of the zero emission vehicle incentives. Tesla sold 80,227 credits during the 11 months through August, which accounted for 86% of the total. And even at prices below what Musk wants, the sales helped Tesla report a profit in the third quarter after having sold $139 million worth of ZEV credits during that quarter.

ZEV credits: The California Air Resources Board may plan this week for the state’s emissions targets to remain largely unchanged through 2025 and then jump after that year, according to three people familiar with the proceedings. This will disappoint Tesla CEO Elon Musk and environmental groups that have called for expansion of the zero emission vehicle incentives. Tesla sold 80,227 credits during the 11 months through August, which accounted for 86% of the total. And even at prices below what Musk wants, the sales helped Tesla report a profit in the third quarter after having sold $139 million worth of ZEV credits during that quarter.  China is facing a challenge similar to the U.S. – how to get car shoppers to buy more clean vehicles and less gas guzzling pollution emitters like large SUVs. While plug-ins, or “new energy vehicles,” have taken off in sales during the past couple of years, China’s regulatory and incentive structure appears to be changing toward a broader definition of clean vehicles. Toyota and a few Chinese automakers and suppliers are asking the government to support plug-less hybrids as another way to reduce tailpipe emissions and dependence on imported oil

China is facing a challenge similar to the U.S. – how to get car shoppers to buy more clean vehicles and less gas guzzling pollution emitters like large SUVs. While plug-ins, or “new energy vehicles,” have taken off in sales during the past couple of years, China’s regulatory and incentive structure appears to be changing toward a broader definition of clean vehicles. Toyota and a few Chinese automakers and suppliers are asking the government to support plug-less hybrids as another way to reduce tailpipe emissions and dependence on imported oil Longest range ZEV: The Honda Clarity Fuel Cell sedan, launching later this year, received a U.S. Environmental Protection Agency driving range rating of

Longest range ZEV: The Honda Clarity Fuel Cell sedan, launching later this year, received a U.S. Environmental Protection Agency driving range rating of  Take a look at

Take a look at  Apple backs off:

Apple backs off:  Delivery is seeing a fast-changing environment, from packages to food. Delivery vans and small, high mileage cars (especially hybrids) are passing through a paradigm shift in who owns the vehicles and how they’re being used. While the U.S. won’t be switching over to delivery bikes and three-wheelers, commonly used in crowded Asian and European cities with narrow streets, competition for leadership in delivery services is getting fierce.

Delivery is seeing a fast-changing environment, from packages to food. Delivery vans and small, high mileage cars (especially hybrids) are passing through a paradigm shift in who owns the vehicles and how they’re being used. While the U.S. won’t be switching over to delivery bikes and three-wheelers, commonly used in crowded Asian and European cities with narrow streets, competition for leadership in delivery services is getting fierce. Fisker Inc.: Henrik Fisker is

Fisker Inc.: Henrik Fisker is