Automakers have understood for years that California, and the overall U.S. market, can’t be depended upon for meeting large-scale sales targets in plug-in electric vehicles. The decline in U.S. sales numbers during 2015 didn’t help, but the overall sales volume had still been small enough for automakers to question their future plans. That’s where global markets have become more important as OEMs look to sell enough volume to justify the resources invested in electric cars through talented employees, R&D, safety and performance testing, marketing spend, and setting up assembly plants to reach economies of scale. That has been the case for Tesla Motors along with its major OEM competitors, which makes China and other overseas markets even more important.

Automakers have understood for years that California, and the overall U.S. market, can’t be depended upon for meeting large-scale sales targets in plug-in electric vehicles. The decline in U.S. sales numbers during 2015 didn’t help, but the overall sales volume had still been small enough for automakers to question their future plans. That’s where global markets have become more important as OEMs look to sell enough volume to justify the resources invested in electric cars through talented employees, R&D, safety and performance testing, marketing spend, and setting up assembly plants to reach economies of scale. That has been the case for Tesla Motors along with its major OEM competitors, which makes China and other overseas markets even more important.

So how did 2015 go in the top 10 markets for EV sales?

Top 10 Countries for EV Sales in 2015

- China 176,627

- S. 115,262

- Netherlands 43,971

- Norway 34,455

- K. 28,188

- France 27,701

- Germany 23,494

- Japan 21,000*

- Sweden 8,908

- Switzerland 6,421

Source: Hybridcars.com

* Approximately

China made up 34.2% of global plug-in electric vehicle sales last year with 176,627 sold and finished in first place. It’s been heavily subsidized by the national government and local branches. There’s been an assumption made that the market’s EV sales will continue to grow – enough for Tesla Motors and other OEMs to invest heavily in the market.

Subsidies for the “New Energy Vehicles” (NEVs) have started to decline. One assessment states that about $4.56 billion in local and central government incentives were spent last year. The government’s five year’s plan will see subsidies in 2017 and 2018 to be reduced by 20% from 2016 levels; and another 20% will be cut in 2019 and 2020. There have been reports made of fraudulent transactions last year and government agencies are conducting investigations. Sales numbers tripled last year, and the data may have been “padded” with some of the EVs being counted twice in the total.

China’s NEV sales have seen rapid growth in the past two years thanks to subsidies and tax cuts. Air pollution in Beijing and other major Chinese cities have been driving the incentives and sales. Tesla Motors and BYD say car shoppers are more interested in owning an EV due to the air pollution – and its making for an effective marketing message. One of BYD’s online ads shows a man in a cloud of pollution calling for help from China’s fabled Monkey King hero.

In October, Tesla CEO Elion Musk announced plans to open the first Tesla manufacturing facility in China, a move that could slash prices for the Model S by more than one-third. The automaker has also bee searching out Chinese manufacturing partners and seeking to streamline Beijing’s complex license-plate lottery for buyers of its cars.

The U.S. was No. 2 with 115,262 EVs sold in 2015, making up 22.3% of the total. China and U.S. are still the leading markets, making up more than 55% of global sales, combined. Sales softened for the first time last year in the U.S. with gasoline prices staying down and consumers waiting for new versions of the Nissan Leaf and Chevrolet Volt to roll out.

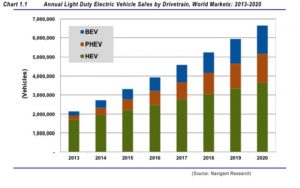

Navigant Research’s John Gartner anticipates that sales volume will go back up in the next couple of years. By 2017, there will be several new EVs for consumers to test drive from Audi, BMW, Ford, GM, and Tesla. Expansion of the charging infrastructure is likely to increase EV adoption, as well. Survey results from Navigant have shown that U.S. consumers see the availability and inconvenience of charging PEVs as the main reasons not to switch from gasoline to electric powered cars.

Automakers are joining up with government agencies, municipalities, and other entities to expand the charging infrastructure. Several automakers now include a free year of access to charging at dealerships and other locations when an EV is purchased. BMW and Nissan recently teamed up to deploy 120 DC fast chargers across country.

Europe has seen substantial growth in EV sales; at about 75,000 new vehicles registered, it was nearly 50% higher last year in sales than was seen in the 2014 numbers. Seven of these nations made the top 10 EV sales list for last year with Norway, France, the U.K., and Germany accounting for about 75% of all registrations/sales for the year.

The Mitsubishi Outlander plug-in hybrid has been the top seller in Europe. Mitsubishi, for now, has left the U.S. market for EV sales and is focusing heavily on Europe; with more than 50,000 units sold in that region since its launch in October 2013.

German Chancellor Angela Merkel recently met with automaker executives on boosting incentives, but the meeting ended without a deal on subsidies being worked out. Merkel called the meeting with high-level executives at German automakers to discuss promoting EVs and hybrids following political pressures to “clean house” in the wake of Volkswagen’s admission that it cheated U.S. emissions tests for diesel-powered cars. OEMs would like to see government action to set up charging stations for electric cars and help fund sales subsidies. There’s been concern about Germany lagging behind other European neighbors in EV sales.

Japan appears to be more focused on supporting growth in hydrogen fuel cell vehicle production, sales, and fueling infrastructure than in supporting EV sales. Toyota and Honda have been investing heavily in fuel cell vehicles and would like to see ample support from the government.

Japan finished 2013 at second place in global EV sales, then dropped down to third place in 2014 and eighth place last year. The government has made some commitments to supporting companies in the EV space, including Panasonic and its EV battery technologies.

South Korea didn’t make the top 10 list and probably won’t for a few years. Hyundai and Kia have been getting into the game during the past couple of years with the low-volume Kia Soul EV battery-electric car; the Hyundai Sonata Plug-In Hybrid; and the recently displayed Hyundai Ioniq that will eventually be released in hybrid, plug-in hybrid, and battery electric versions.

So far, the most popular EV sold in the South Korean market has been the Renault Samsung SM3 ZE (known in Europe as the Renault Fluence ZE). The numbers haven’t been very high – with nearly 1,800 sold overall in the world since its launch two years ago.