ChargePoint and McKinsey & Co. have put out studies in the past week offering an interesting look at the state of plug-in electrified vehicles and the charging infrastructure in the U.S. and abroad.

ChargePoint and McKinsey & Co. have put out studies in the past week offering an interesting look at the state of plug-in electrified vehicles and the charging infrastructure in the U.S. and abroad.

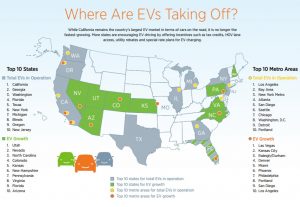

California continues to be the leading U.S. market for registered PEVs on its roads, with about half of all battery electric and plug-in hybrid electric vehicle sales taking place there, according to the ChargePoint study. Georgia, known for its generous PEV incentives, was No. 2 on list. Washington was No. 3, but a surprising ranking was Oregon coming in at No. 9 when it’s been very competitive with Washington and California as part of the PEV charging highway infrastructure. Florida and Texas came in at Nos. 4 and 5 on list. Four other strong markets made the list with New York at 6, Michigan at 7, Illinois at 8, and New Jersey at No. 10.

As for the PEV market growth, another surprising state made the list, with Utah at No. 1, followed by Nevada, North Carolina, Colorado, Kansas, New Hampshire, Pennsylvania, Virginia, Florida, and Arizona. ChargePoint compiled the report’s findings with date provided by IHS Market through the third quarter of 2016. Growth figures for these top 10 states represent growth over Q3 2015.

As for cities seeing the strongest presence based on PEVs in operation, California had three of the cities, with Los Angeles at No. 1 over San Francisco at No. 2 (another surprise), and San Diego at No. 5. New York came in at 3, Atlanta at 4, Seattle at 6, Chicago at 7, Washington, D.C. at 8, Detroit at 9, and Portland, Ore., at 10.

As for PEV growth cities, several of them are considered to be significant business centers for conferences and meetings. Charging stations are being installed at airports, hotels, retail stories, and workplaces, supporting regions that have economic growth and interest in PEVs. Las Vegas was the No. 1 city in PEV growth in the past year, followed by Kansas City, Raleigh/Durham, Denver, Miami, Phoenix, Philadelphia, Portland, San Diego, and Los Angeles.

The charging company also reported on the Top 5 PEVs sold in the U.S. last year. The Tesla Model S was No. 1, followed by the Chevy Volt, Ford Fusion Energi plug-in hybrid, Tesla Model X, and the Nissan Leaf. According to Baum and Associates and InsideEVs.com, it split at 53% battery electric and 47% and for plug-in hybrids.

Gasoline prices were an interesting trend to see studied in the report. PEV sales used to be very tied to gas prices, but for over two years these prices have stayed down in and stable in the U.S. Consumers had been very interested in saving money. Now the sales chart shows that PEV sales have gone up as gas prices have stayed down. Consumers are interested in PEVs for reasons beyond gas savings, according to the study.

McKinsey on seeing breakthroughs in PEV sales

A new study by global consulting firm McKinsey & Co. looked at where consumers in key markets, and automakers, see adoption of PEVs going in the next few years. Electrifying insights: How automakers can drive electrified vehicle sales and profitability digs into consumer tastes and interests, and where auto manufacturing is heading in response.

Two studies were conducted with consumers interested in PEVs and consumers who own them. About 3,500 people were surveyed in the U.S., Germany, and Norway; and a second study was done with about 3,500 people in China interested in, and owning, PEVs.

The core issue for automakers is being overwhelmed by new technologies to invest in to meet emissions standards around the world, and to prepare for growing interest in PEVs of all types. As automakers invest a great deal of capital in fuel efficient technologies like start-stop, turbocharging, and lightweighting, investing sufficiently in battery packs and other needed components loses some of its value. That’s been intensified by growing interest in connected, autonomous vehicle systems.

Consumers are becoming more interested, and have a few factors they’re questioning and considering:

- About half the surveyed consumers in the U.S. and Germany say they understand how PEVs work. Between 30-and-45 percent of vehicle buyers in the U.S. and Germany, respectively, have considered a PEV purchase. Strong demand is being seen in Norway and China, where incentives have been ample and have been seen in sales results.

- The study sees reaching the other half of consumers in these countries to be an important opportunity, but the message will need to be revised.

- Making batteries with more capacity will be a big part of getting past limited sales, and getting their cost down for manufacturers is part of it. The study says it’s costing automakers about $13,600 for the battery pack with 60 kWh of power. There are other costs that go into it such as the electric motor, high-voltage wiring, on-board chargers, and inverters.

- There’s also keeping it all within economies of scale. Adding a new PEV and building it at decent numbers means a lot of capital being place in opening up a new factory, or opening lanes at an existing plant, tooling, R&D and getting the product to market through dealer networks retail stories, and launching marketing campaigns.

- Premium luxury cars by Tesla Motors and a few competitors are taking a lot of the sales, but there’s been a bit of a void for consumers interested in a wide selection of small cars, SUVs, and crossovers. McKinsey sees this as one of the opportunities, especially for consumers living in cities looking for more options and spending less on their vehicles.

- Automakers and dealers would be smart to sell PEVs from a different perspective. Instead of purchase price and lease deals, focusing on total cost of ownership (TCO) would be a better way to go. For example, PEV owners are typically paying about 20% to 40% less on maintenance costs over a five-year period compared to vehicles with internal-combustion engines.

- Growth in ride-hailing, carsharing, and peer-to-peer car rental are expected to have strong PEV market potential, according to McKinsey. The study found that more than 30 percent of consumers surveyed would prefer a PEV model over an ICE when using ride-hailing services such as Uber and Lyft; and about 35 percent would pay a premium to ride in a PEV.

- Carsharing provides an opportunity to get consumers to try out a PEV through promotional offers. Companies such as Maven, Zipcar, and Car2go could tap into this market potential.

- Another service to provide could be P2P (peer-to-peer) car rental. Consumers who own a PEV could make money renting out their car when it’s not being used.