It was sad to see the oldest car rental institution in the world, Hertz, file for Chapter 11 bankruptcy on Friday, given the severe impact of COVID-19 on travel and the economy. But the story is a much bigger one — it reflects the difficulties of  building a solid, profitable company in the car business with healthy cash reserves to survive a catastrophe; and it points to the fundamental changes in how people will be using cars, travel, and taking short rides in the city, in the years ahead.

building a solid, profitable company in the car business with healthy cash reserves to survive a catastrophe; and it points to the fundamental changes in how people will be using cars, travel, and taking short rides in the city, in the years ahead.

I’d learned a lot about the car rental business and other elements of its supply chain — automaker fleet departments, airlines, hotels, travel management companies, reservation systems, and the used car remarking arm — as the editor of Auto Rental News; and later working with car rental industry expert and consultant Neil Abrams as the manager of his Abrams Travel Data Services business unit. Learning about the nuts and bolts of how car rental companies work gave me a wonderful education in economics, the auto industry, and the growing importance of travel to consumers and corporate executives — almost like an MBA. Automotive Digest Publisher Chuck Parker had served as the publisher of ARN, and encouraged me to take that publication where I wanted it to go — analyzing market data and offering readers a big-picture perspective on how all of this dynamic change would likely affect their future.

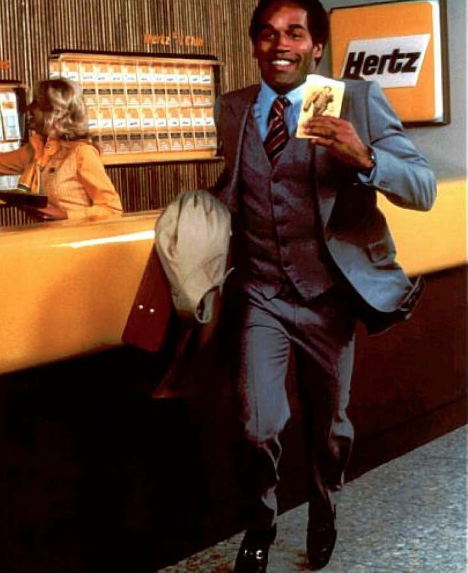

A Bloomberg article on the Hertz bankruptcy cited a ranking of top car rental companies that I put together for ARN in 1994. It ranked Enterprise its new No. 1 by fleet size and number of offices, bumping Hertz off its top spot for the first time. It was also during the time when Hertz’s advertising spokesman OJ Simpson was taken off his mantle and had his years-long contract with the auto rental giant taken away as his murder trial was scheduled. The 1990s also saw the beginning of company mergers and buyouts; and smaller car rental companies having to shut down and leave the business. The global economy was seeing similar trends with mergers and acquisitions taking center stage for automakers, airlines, hotels, media and entertainment companies, banking and investment firms, healthcare, and tech companies.

Over the next 20 years, we would see Enterprise purchase National and Alamo, Avis buy Budget and car sharing leader Zipcar, and Hertz buy Dollar and Thrifty. Hertz would take on Enterprise in the local market with its Hertz Local Edition division — offering replacement cars for repair and service, and weekend rentals to nearby residents who wanted a nice big vehicle to take a road trip. Hertz and Enterprise started car sharing units to compete with Zipcar and its parent Avis, along with Daimler’s car2go and General Motor’s Maven business units.

But what’s happened since then?

—Building a profitable business model continues to be tough: Carl Icahn, a famous activist investor with plenty of holdings in the oil industry, could lose big with Hertz. Icahn, who owns nearly 40 percent of Hertz, is expected to lose his entire $1.5 billion investment if the company can’t survive its reorganization. Icahn had stepped in during 2014 to stabilize the company’s debt from its acquisition of the Dollar and Thrifty car rental competitors, and to take on competition from new modes of transportation led by Uber. Hertz had owed about $500 million in debt recently and had renegotiated a longer payment plan — given that it only had $1 billion in capital; but that payment was missed. The game is changing dramatically and COVID-19 isn’t at the root of it. It’s not the profitable model that major investors and stock market shareholders will need in the new economy. That’s the same for automakers, with Tesla going outside the norm as high-performing stock to own — unlike GM, Ford, and the other major manufacturers.

—Competitors like Enterprise, Avis, Uber, Lyft, and Zipcar, are preparing for a future with autonomous, shared, and electric rides. That’s also the case for the two giant European car rental companies, Sixt and Europcar. But the car rental giants haven’t even started offering customers electric cars for rental. They might have a few hybrid models, but they have been sticking to the traditional vehicle choices. Hertz was set back by not getting enough SUVs into its fleet recently — as gasoline prices have stayed down and renters want to load up midsize-to-large crossovers and SUVs for long road trips. But that’s expected to change in the new decade as we emerge from the coronavirus, as environmental regulations take hold in North America, Europe, and Asia — meaning less gas-guzzling trucks and SUVs, and more electric cars and fuel-efficient vehicles. Consumers and fleets are starting to become more interested in owning EVs and taking shared, automated rides in autonomous shuttle buses. That will take a while to get a firm hold in the marketplace, but expectations are starting to change. Some analysts believe that COVID-19 is continuing to cause a series of changes in the general public’s priorities and expectations.

—Most companies in the global economy are dependent on steady revenue streams based on demand with very little in capital reserves — as well illustrated by Hertz. When demand gets sidetracked for whatever reasons, there goes the company. Japan’s lean supply chain model has had a great deal of influence on all of it, but that was discredited in part by the 2011 nuclear power disaster — and its harsh impact on automakers around the world dependent on Japanese suppliers. Some countries like Japan are more willing to bail out their major corporations and keep their share. The US gave GM and Chrysler great deals with low-interest loans on their post-bankruptcy bailouts that were paid off. Will Hertz be able to find it from the Trump administration to emerge from BK in a stronger position?

—Hertz will have to save face on generous executive payments. Hertz Global Holdings said today it has paid about $16.2 million in retention bonuses to a range of key executives. President and chief executive officer Paul Stone was paid $700,000, and executive vice president and chief financial officer Jamere Jackson $600,000 as retention bonuses, Hertz said in a filing to US regulators. That doesn’t look very good after laying off 10,000 of its employees in April. The business community and consumers do expect more from corporations these days — honest reporting, equity, treating employees respectfully, adopting sustainability practices, and supporting their local communities.

—Car rental holding companies are in a sound position for being leading players in the future of mobility. They have the largest fleets in the world, historic brand names and public awareness, and infrastructures in place for serving airports and, especially for Enterprise and Hertz, serving local markets including much-needed replacement vehicles. What about adding EVs, autonomous shuttles, hourly rentals, and cheaper shared rides?

—Car rental companies are facing a serious turning point. How will they compete in car sharing when those companies start to grow their audiences and car rental companies haven’t taken the segment very seriously? What about rental electric cars? It’s not happening yet. How do you compete with ride-hailing and ride-sharing giants out there in the global market? Consumers are changing their mobility methods and business travelers have been leaning in this direction too. COVID-19 and emerging from bankruptcy offer rare opportunities for stepping forward and doing the right thing.