Buses used by transit agencies and school districts have become one of the most significant growth sectors for clean transportation in the US and worldwide, with electric buses gaining much of that attention over the past year. However, it is useful to get a big picture overview of where green buses are today — and that includes buses powered by natural gas, hybrid systems, biodiesel, battery electric, propane, and hydrogen.

Chinese maker BYD is perceived as the dominant force in electric bus development and sales — but it’s not the largest e-bus maker in China or the world. Plus, there are a number of domestic and global busmakers that are making big moves in this space.

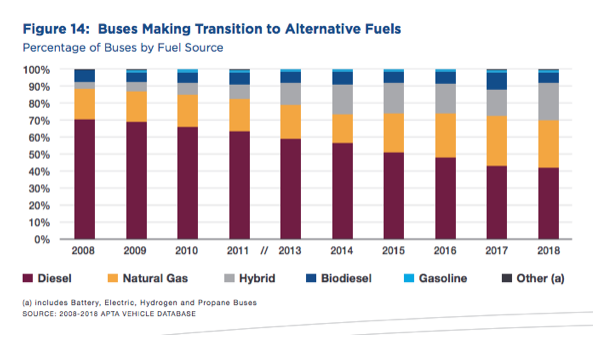

Natural gas and diesel hybrid buses were the first to be added to several transit fleets in US cities between 2005 and 2010, with biodiesel, battery electric, hydrogen, and propane following. A chart in American Public Transportation Association’s 2019 report tells a lot more of this story, and how diesel has been declining in recent years…………..

Source: 2019 Public Transportation Fact Book, American Public Transportation Association

According to the American Public Transit Association (APTA), alternative fuels and advanced hybrid drivetrains powered more than half of all transit buses in 2017 and 2018. Between 2008 to 2018, the share of conventional diesel buses dropped from 70 percent to 42 percent.

Natural Gas:

The fuel became the first alternative replacing diesel to be tried by several transit agencies, with incentives coming from several states to convert existing buses over to compressed natural gas powertrain systems and to construct refueling infrastructures at existing onsite gas stations. NGVAmerica reported that transit agencies have about 11,000 natural-gas powered buses in operation. It makes up about 35 percent of new transit bus orders these days. US school districts have also taken the fuel very seriously, with more than 150 of them operating about 5,500 natural gas powered vehicles in their fleets to move students.

Seven vehicle manufacturers have offerings in heavy-duty CNG-powered buses for the US market — Thomas Built Bus, Optima/NABI, New Flyer, Motor Coach Ind., Gillig, El Dorado, and Blue Bird Bus. Selling points include saving millions in fuel cost, reducing emissions (especially when renewable natural gas can be utilized), and running quieter buses than what comes from diesel engines. Bus fleets around the world have been able to make the case for bringing in CNG-powered vehicles in recent years. New Delhi is operating the largest fleet — about 5,500 CNG-powered buses through Delhi Transport Corp. and the Delhi Integrated Multi-Modal System (DIMTS).

Hybrid Buses:

Metro bus operators are using hybrid diesel-electric buses manufactured by Azure Dynamics Corp., Ebus, New Flyer, Gillig, Motor Coach Industries, Orion Bus Industries, North American Bus Industries, Mitsubishi Fuso, Volvo Buses, and many more. Many bus makers are partnering with three major hybrid system manufacturers — GM-Allison Transmission, BAE Systems, and ISE Corporation. Most of the hybrid buses end up in the US, Canada, China, UK, Norway, and Germany.

Biodiesel:

Using B20 and lower biodiesel blends has been a way for hundreds of US school districts and universities to reduce the health risks for staying with diesel fuel. It blends biodiesel fuel meeting ASTM D 6751 requirements with petroleum-based diesel fuel. School boards back it as it offers of low-cost method to meet air quality concerns on its fleet of diesel buses that require no modifications. It can run on existing engines and fuel injection equipment. The fuel is made from vegetable oils or animal fats with restrictions on what can be used to protect engine life.

Battery Electric:

All-electric metro buses have seen a wave of growth in recent years — including 32 percent in 2018. There are about 430,000 of them in operation today — about 17 percent of the world’s buses. But about 99 percent of them are in China, according to a report last year by Bloomberg’s New Energy Finance. Cities in North America and Europe are bringing them in, and California is requiring all new bus purchases to be zero emission by 2029. Europe has seen an increase from around 200 e-buses to 2,200 over five years.

China’s BYD has been the star of the show, signing contracts for acquisitions all over the world and especially in the US and Latin America. However, another Chinese manufacturer, Yutong, has the lead in the market. Yutong has already sold more than 120,000 battery-electric buses, compared to No. 2 competitor BYD with its 50,000-plus unit mark. (By the way, Yutong is also the world’s largest bus manufacturer.)

BYD continues to sign impressive deals including bringing a 20-bus order to Los Angeles World Airports in December, and passing the 400th e-bus delivery mark from its Lancaster, Calif., assembly plant. That makes up the lion’s share of the estimated 650 electric transit buses in service in the US. However, BYD is nervous about the National Defense Authorization signed recently by President Trump. It takes effect in two years, and would ban mass transit agencies from using federal funds to purchase buses or rail cars from Chinese-owned or Chinese-based companies. But there are other markets, including selling about 1,000 electric buses in Latin America so far, and setting up plants in Canada, France, Hungary, and a new joint venture in the UK. The BYD K9 low-floor bus had been one of the most popular of its models.

In the US, local businesses are taking on e-buses to become BYD-competitive. Thomas Built Buses will delivery 50 of them to Dominion Energy in its partnership with Virginia school districts. The utility and school district want that to go up to 1,000 units by 2030 (though Thomas Built has not been handed over that entire contract).

Proterra is considered to be BYD’s leading competitor in electric buses, with contracts signed transit authorities in New York City, Washington, DC, and Philadelphia; and airports in San Jose, Calif., Raleigh, and Sacramento. Belgian busmaker Van Hool has announced a partnership with Proterra, to provide drive trains and batteries for its new line of electric coaches. Proterra, Inc., operators two plants and also offers electric charging systems and energy storage. Its Catalyst series ranges in sizes from 35 to 40 feet in length with various battery configurations.

Other companies to watch breaking into the North American e-bus market: GreenPower Motor Co. in all-electric transit and the micro-transit market; other markets served include school buses, shuttles, a cargo van, and a double decker. Gillig Electric Bus Co. started last year through bus giant Gillig LLC and engine maker Cummins Inc. Another major player, New Flyer, continues to close impressive deals such as one with King County Metro what will delivery up to 120 of its all-electric Xcelsior Charge buses.

Propane:

Propane leads the way with school buses switching over the clean fuels — more than 15,200 propane-powered school buses are out there now, according to research from the Propane Education & Research Council (PERC). And more of these vehicles have been added to school bus fleets since the report was published. Transit districts are also using propane-powered buses in their fleets. That list includes San Diego Metropolitan Transit System, Delaware Transit Corp., and Michigan’s Flint Mass Transportation Authority.

Bus manufacturer Blue Bird has partnered with Roush CleanTech, bringing in its liquid propane autogas system to models such as the Blue Bird 4th Generation Vision Propane bus and Micro Bird G5. The school bus market has been the main focus. Navistar is entering the market through a partnership with Power Solutions International Inc. and its 8.8-liter propane engine.

Hydrogen Fuel Cell:

Hydrogen is just starting to break into the bus market, primarily in California transit agencies and the Hubei provide in China, which plans to bring in 3,000 fuel cell buses over the next two years. Toyota will be operating more than 100 hydrogen-powered buses during the 2020 Tokyo Olympics.

Fuel cell bus makers in the US include Van Hool, ENC, Ebus, New Flyer, ElDorado, and BYD. Ballard, US Hybrid, UTC Power, and Hydrogenics are major fuel cell suppliers. Daimler, the world’s largest truck maker, plans to commercialize a hydrogen-powered transit bus in the next two to three years.

Overal Bus Market — who could be gaining share in clean fuels at some point

Bus majors to watch include Daimler, Scania, Volvo, China’s King Long, Yutong, Hyundai, Iveco, Tata Motors, and Paccar. In the US, the three largest suppliers of buses in the transit market are Canadian company New Flyer, Gillig, and North American Bus Industries (although New Flyer and NABI merged in 2013, creating the industry’s giant). Ontario-based Orion also supplies some of that market. Major players in Europe include ADL Solaris, VDL, Volvo, Ursis, and Bollore. The green bus market is expected to become even more competitive over the next decade.

Other interesting news………

- Elon Musk has a new enemy that uses the $TSLAQ hashtag. The group consists of accountants, lawyers, hedge fund managers, and former Tesla employees, who post social media analysis of Tesla executive departures, lawsuits, customer complaints, accidents, and other topics.

- UPS has placed an order for 10,000 electric delivery vans from UK-based company Arrival. The initial 10,000 vehicles will be rolled out in the UK, Europe, and North America from 2020 to 2024 with the option to purchase a further order of 10,000 vehicles. UPS venture capital arm also announced an investment in Arrival of an undisclosed amount.

- For those preparing the next disaster: The US Department of Energy (DOE) and the Department of Defense (DoD) will support an opportunity to address disaster mitigation through the use of an advanced fuel truck technology concept known as H2Rescue. The H2Rescue is a fuel cell/battery hybrid truck that first responders and the military can drive to disaster mitigation sites. It can provide sufficient hydrogen to provide power, heat, and even potable water for up to 72 hours.

Hello Jon,

Good article. Several transit agencies such as Culver City and LA Metro took on the challenge of using natural gas back in 1987. Many of us looked at the trends and future of different fuels, discussed the changes in the “Fleet Rules” rules with the SCAQMD, and make a conscientious decision to move away from dirty diesel. Culver City became the second transit property in the state of California to become 100% CNG powered (2008). With the use of renewable natural gas, arguably, these transit buses/vehicles (using RNG) produce less at .01% of any carbon or c02 making them as clean as electric vehicles (considering the use of coal generation to product electricity). RNG is plentiful, extremely clean and 100% produced in the USA!!

Fleets wanting to make the transition away from dirty diesel or other dirty fuels need to consider several factors and create policy to be successful. I wrote and published a White Paper to help fleets make the transition with what I call the “Six Steps”. I’m happy to send this to you to use if you wish.

Keep the great articles coming!!

Thanks.

Paul Condran

Retired Fleet Manager

mpcsmc/Consulting

Sorry. Correction to the initial date. It was not 1987. It was 1998.

Thank you.

With thousands of new EV charging stations created soon, the future of electric metro buses is brighter as of now. According to Plugshare, there are thousands of EV Charging Stations in US which are operational.

https://www.plugshare.com/directory/us