Fossil-fuel subsidies are needed in the U.S., but not nearly as much as in many other countries. A new study from Our World in Data details countries that have the heaviest amounts of subsidies provided to fossil-fuel suppliers.

While the Trump administration is now working out how possible tariffs could be enacted with Canada, Mexico, China, and a new proposal just came up on adding 25% tariffs on steel and aluminum, fossil-fuel subsidies will likely continue as is. Automakers, suppliers, and infrastructure providers are anxiously waiting to learn more about whether grants will be going forward and the National Electric Vehicle Infrastructure (NEVI) program (see below for more).

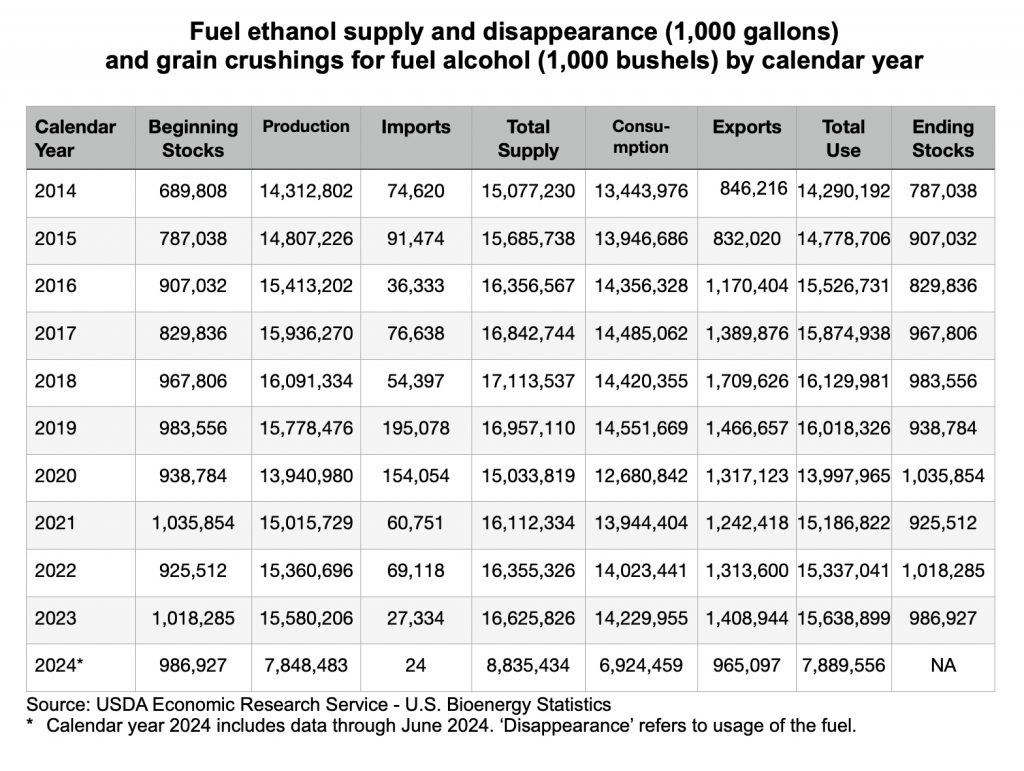

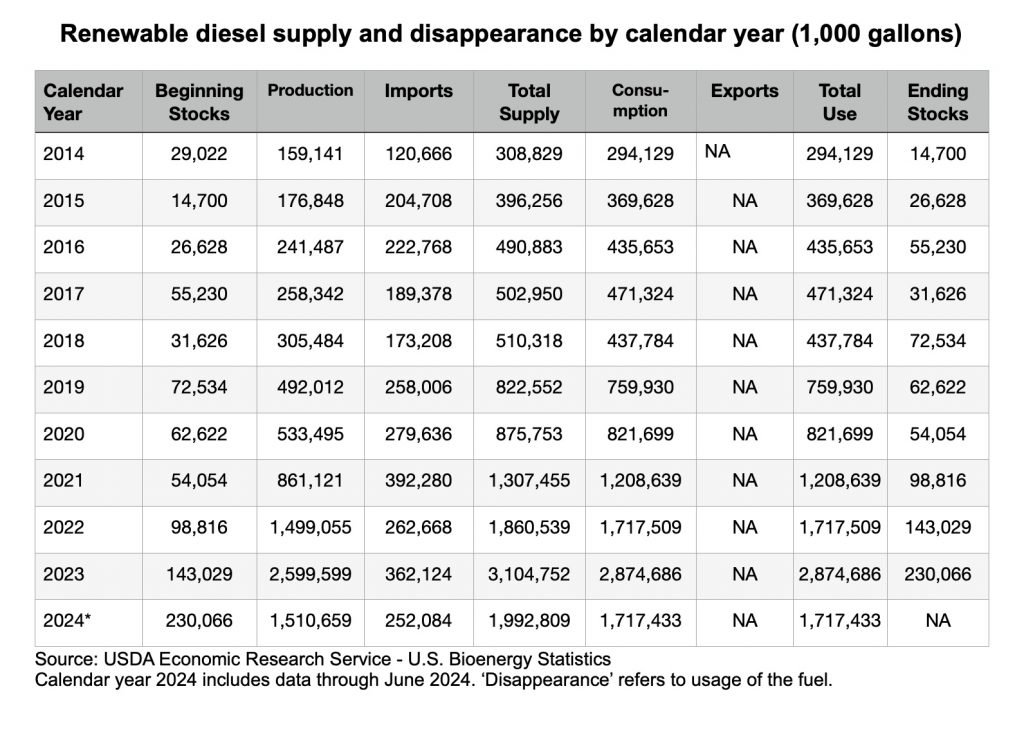

Americans consumed 137.05 billion gallons of gasoline in 2023, compared to 142 billion gallons in 2007, according to the U.S. Energy Information Administration. But it could it have been at much higher consumption level in 2023. The population has been increasing as have the number of vehicles since 2007. There were 254.4 million registered vehicles on American roads in 2007 versus 296 million in 2024, according to the Federal Highway Administration. That gasoline consumption decrease has come from more fuel efficient vehicles being sold, along with the amount of battery electric, plug-in hybrid electric, and hybrid vehicles on our roads. Alternative fuels such as renewable natural gas and renewable diesel are making their way to fleets as well, along with electric and hydrogen-powered trucks.

Those numbers — gasoline and diesel consumed, natural gas and coal used to power the electricity grid, and other segments like petrochemicals — have not been reduced enough in the U.S. and globally to make much-needed improvements in air quality and climate change. There’s still a long way to go.

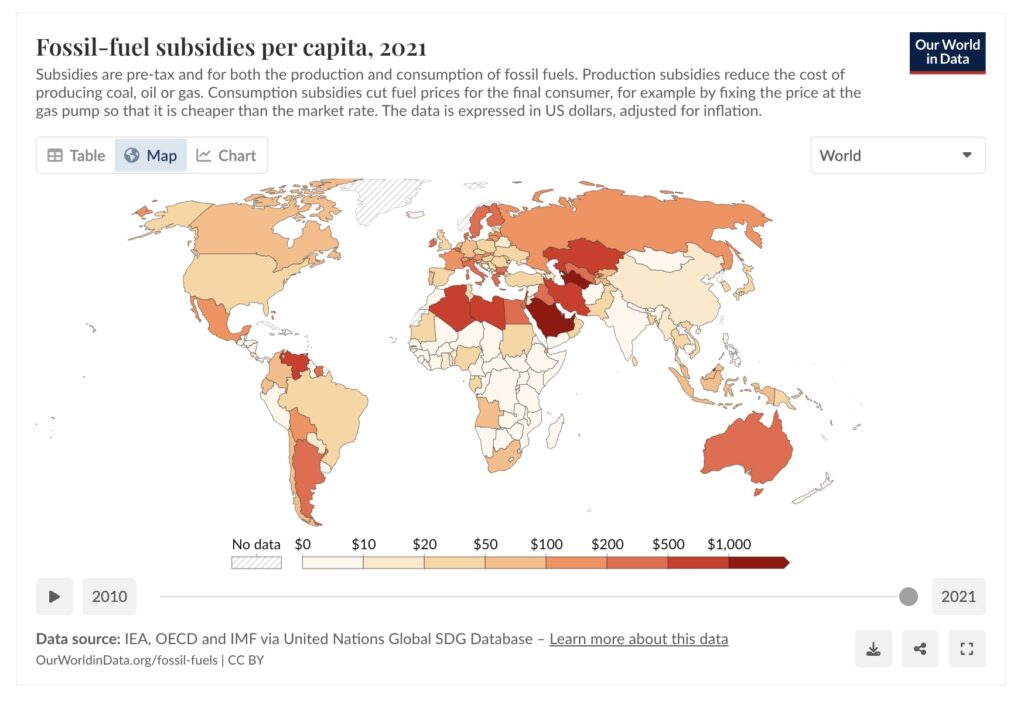

Like corn growers and other industry segments, oil companies and their partners — oil refineries, fueling stations, natural gas suppliers, and more — are seeing government subsidies all over the world to reduce the distribution costs and to keep the prices stable for end users. The chart above from Our World in Data shows you countries that have the heaviest amounts of subsidies provided to fossil-fuel suppliers. It’s well over a trillion dollars a year in global subsidies.

Saudi Arabia and Turkmenistan have the highest levels of subsidies. The U.S. is much lower. For example, these subsidies average out to $28.16 per capita versus $83.60 per capita in Canada. That might have something to do with the U.S. having an ample supply of oil and gas domestically, and a good deal of it coming from Canada. Gasoline and diesel prices stay relatively stable in the U.S,, though that could be volatile for a while if the U.S. goes through with the Trump administration’s threatened tariffs on Canadian imports.

Nikola BK: A recent report says that hydrogen-electric truck maker Nikola Motors is getting close to bankruptcy. That comes from an article from The Wall Street Journal. Nikola has been working with law firm Pillsbury Winthrop Shaw Pittman to explore options. These may include a sale or a restructuring in bankruptcy. A company representative has stated that the company is still assessing its financial position and liquidity needs.

Jeep Super Bowl ad: Harrison Ford told the Super Bowl audience yesterday that “we get to write our own stories” and that freedom in American is “Yes. Or No. Or maybe.” The ad includes scenes of Jeep electric vehicles as well as those with internal combustion engines. “Freedom is the roar of one man’s engine. And the silence of another’s,” the actor says. “We won’t always agree on which way to go, but our differences can be our strength.” Near the end of the TV commercial, Ford gets into an electric Jeep Wrangler and says, “Choose what makes you happy,” quickly adding: “This Jeep makes me happy…. even though my name is Ford.”

Trump halts NEVI program: The Trump administration on Thursday said it would halt a program intended to build the infrastructure needed for the future of transportation in America. In a memo from the Federal Highway Safety Administration, states were ordered to halt spending on the National Electric Vehicle Infrastructure (NEVI) program intended to build fast EV chargers along highways nationwide. The program calls for 500,000 charging stations nationwide, and was funded with $7.5 billion under the 2021 infrastructure law to make that happen. That total was split into $5 billion for a highway-based program, and $2.5 billion for rural and underserved communities, with states submitting proposals for use of the available funds.

The Electric Drive Transportation Association (EDTA) has asked the Trump administration to restore the NEVI program, which the organization called “an effective and important element of a truly strategic energy policy that promotes U.S. innovation, domestic investment, and energy security.”

RNG Coalition challenges GHG Protocol: Following the withdrawal of guidance on the use of renewable natural gas (RNG) certificates in the GHG Protocol, over 130 companies and trade associations from around the world have today issued a public joint letter to the governance bodies of the GHG Protocol calling for the key role of market-based instruments to be recognized in the Protocol’s Scope 1 inventory. Their message to the GHG Protocol is simple: Let Green Gas Count. Led by the Anaerobic Digestion and Bioresources Association (ADBA), The Coalition for Renewable Natural Gas (RNG Coalition), Eurogas, the European Biogas Association (EBA), and the World Biogas Association (WBA), the signatories represent economic operators globally responsible for the production, trading and consumption of renewable gaseous fuels and their derivatives. They underline the urgent need for a climate reporting framework that provides rules and certainty for investment in their sectors. Renewable gases and their derivatives are necessary to decarbonize industry, transport and buildings. To facilitate their rapid deployment, a market-based approach is required to overcome any economic, technical and environmental barriers and inefficiencies arising from the requirement of a physical (local) connection, the group says. GHG Protocol is a 20-year partnership between World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD). The organization works with governments, industry associations, NGOs, businesses and other organizations.

What’s up with that new Honda logo? Have you noticed that Honda has a new logo out there? It’s not the slightly modified ‘H’ that will be appearing on a few upcoming electric models that we’ve heard about, including the Honda O Series models. It’s a clean-and-simple spelling out of the Honda name on the back of its all-electric 2024 Honda Prologue, which the company has not talked about in media announcements and photos. It appears on a black bar above the license plate.

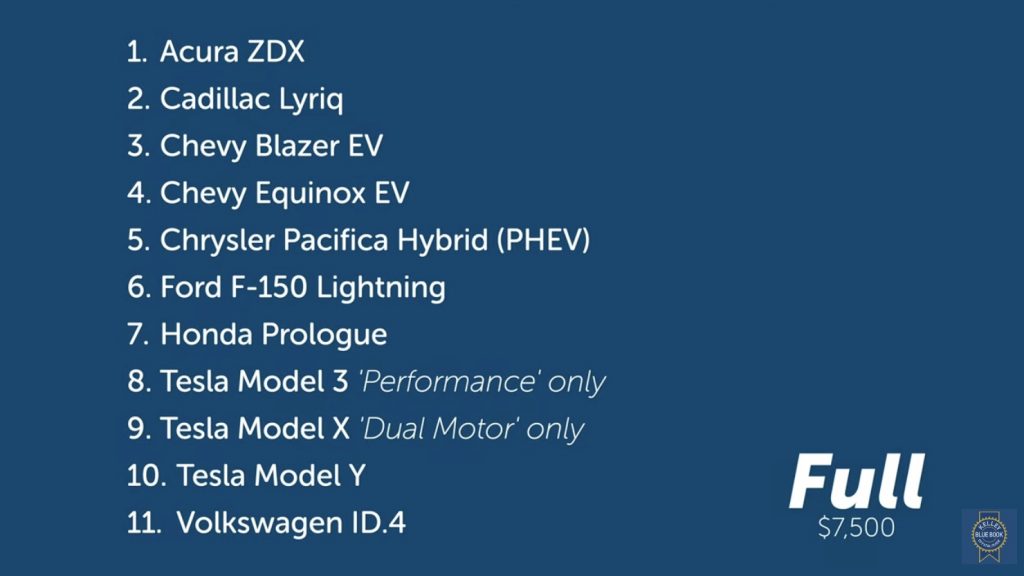

The Prologue is an all-electric SUV that’s built on the same platform as the Chevrolet Blazer EV. The Prologue is assembled in Mexico using GM powertrain components and Ultium batteries. The 2024 Prologue is eligible for the federal electric vehicle tax credit of $7,500.

Honda has been moving its production plants into Marysville and East Liberty, Ohio in recent years, and it also has facilities in Lincoln, Alabama and in Greensburg, Indiana. The company moved about 50 employees from its Torrance, Calif., headquarters over to Ohio in 2017. Honda corporate tends to be more quiet about its brand imaging, manufacturing plants, and model changes, than does its Japanese competitor, Toyota.

Honda’s 2024 sales data, released earlier this month, said that 33,017 Prologue EVs were sold in 2024 in the U.S. It beat the gasoline-powered Honda Passport by about 500 units; that was impressive, given that the Prologue wasn’t available for sale and delivery until about the middle of 2024.